The Russian tile and ceramic market is a vast and dynamic arena, a strategic battlefield where local giants and international powerhouses vie for market dominance. Unlike more static industries, this sector is in constant flux, driven by an intricate blend of domestic construction trends, evolving consumer tastes, and the global forces of innovation and competition. Understanding the intricacies of this competitive landscape is not merely an academic exercise; it is an absolute necessity for any business looking to secure its place, or expand its influence, in one of the world’s most significant building materials markets.

This comprehensive analysis delves deep into the core competitive dynamics of the Russian market. We will dissect the strategies of key domestic manufacturers and international players, identify the crucial factors that determine success, and project the future trajectory of the industry. From the unique challenges posed by Russia’s geography and economy to the groundbreaking opportunities presented by technological advancements, this article provides a strategic roadmap for navigating the complexities and seizing the opportunities that lie ahead in the Russian tile and ceramic sector.

A Market in Motion: Size, Structure, and Key Drivers

Before analyzing the competition, it’s vital to grasp the sheer scale and segmentation of the Russian tile and ceramic market. As a sector closely tied to the broader construction industry, its health is a direct reflection of Russia’s economic vitality and its urban development policies.

Market Size and Segmentation: A Dual-Sided Demand

The Russian tile market is characterized by a dual-sided demand: large-scale new construction and a constant, steady stream of renovation projects. The residential sector, in particular, accounts for the largest share of demand, fueled by government-backed mortgage programs and a persistent urban migration. This new housing boom creates a high-volume, price-sensitive market for basic and mid-range tiles.

Simultaneously, the vast stock of existing housing units, many dating back decades, represents a massive and ongoing market for renovation. This segment is often more aesthetically driven, with consumers seeking higher-quality, unique designs, and specialized products. The commercial sector, including offices, shopping centers, and public infrastructure, also provides a consistent and premium demand for durable, high-performance ceramics.

Primary Drivers of Market Growth

The growth of the Russian tile and ceramic market is not accidental; it is driven by several powerful macroeconomic and social forces. These include:

- Government Housing Initiatives: Programs aimed at increasing homeownership and modernizing urban infrastructure provide a stable, long-term foundation for demand.

- A Growing Middle Class: As disposable income rises, Russian consumers are shifting their focus from purely functional materials to products that reflect a more modern, aspirational lifestyle.

- Urbanization: The concentration of populations in major cities and their surrounding suburbs leads to continuous construction and development, from new high-rises to sprawling commercial hubs.

The Competitive Arena: A Battle Between Domestic and Foreign Titans

The Russian tile market is not dominated by a single force but is instead a fiercely contested space where domestic producers and international exporters have carved out their own distinct niches.

The Rise of Domestic Producers: Strengths and Strategic Advantages

Over the past decade, Russian ceramic manufacturers have significantly invested in modernizing their facilities and expanding their production capacities. This has transformed them from regional players into powerful national contenders. Their primary strategic advantages include:

- Cost Leadership: With access to local raw materials and a strong, integrated supply chain, domestic producers can manufacture tiles at a lower cost than most international competitors. This allows them to dominate the mass market, particularly in the mid- to low-end segments.

- Logistical Efficiency: Russia’s immense size makes logistics a complex and costly endeavor. Domestic producers, with established distribution networks and warehousing facilities, can deliver products to key regional markets with greater speed and cost-effectiveness.

- Market Familiarity: Russian manufacturers possess an inherent understanding of local consumer preferences, cultural tastes, and design trends. This allows them to quickly adapt their product lines to meet specific demands, such as the preference for certain color palettes or patterns.

The Role of International Importers: Market Positioning and Brand Strategy

Despite the strength of local production, international tiles hold a significant market share, particularly in the high-end and design-focused segments. These importers rely on a different set of competitive advantages:

- Brand Reputation and Design: Italian and Spanish tiles are the gold standard for design, quality, and luxury. They are often the preferred choice for architects, designers, and affluent consumers. Their brands carry an association with European elegance and craftsmanship that domestic producers find difficult to replicate.

- Technological Innovation: Foreign companies, particularly from Italy, Spain, and China, often lead the way in introducing cutting-edge manufacturing techniques, such as advanced digital printing, large-format tile production, and novel material compositions.

- Product Diversity: Importers offer a vast range of specialized products that may not be available from domestic manufacturers, including niche items like unique mosaics, anti-slip tiles for industrial applications, and specialized porcelain stoneware.

The competitive landscape is therefore a clear-cut segmentation: domestic players dominate the high-volume, price-sensitive segments, while international brands command the premium and specialized niche markets.

Key Factors Shaping Competitive Advantage

Winning in the Russian market requires more than just a good product. It demands a sophisticated strategy that addresses the unique challenges and opportunities of this dynamic environment.

Innovation as a Differentiator: Technology and Design

In a market where basic functionality is a given, innovation becomes a primary differentiator. Digital printing technology has revolutionized the industry by allowing for an almost infinite variety of designs, from realistic wood and stone textures to intricate geometric patterns. Companies that have invested heavily in this technology—both domestic and foreign—are setting the pace. The demand for large-format tiles is also a key trend, driven by a preference for minimalist and seamless interior designs. The ability to produce and distribute these large, heavy, and delicate tiles is a significant competitive barrier to entry.

Mastering Distribution Channels and E-commerce

A successful competitive strategy hinges on a robust distribution network. This involves leveraging a mix of channels:

- Wholesalers and Distributors: These partners are essential for reaching regional markets across Russia’s vast geography.

- Retail Chains: Large DIY (Do-It-Yourself) and construction material hypermarkets, like Leroy Merlin and Petrovich, have become dominant players, acting as key points of sale for mass-market products.

- E-commerce: The digital marketplace is rapidly growing. Companies that have invested in user-friendly websites, effective online marketing, and reliable logistics for home delivery are gaining a significant advantage, especially in reaching younger, digitally savvy consumers.

Adapting to Economic and Geopolitical Headwinds

The Russian market is not immune to external factors. Fluctuations in the ruble’s exchange rate can dramatically impact the cost of imported tiles, while geopolitical shifts and sanctions can disrupt supply chains. Successful players are those who can build flexible and resilient strategies, from localizing production to diversifying their sourcing, to mitigate these risks and maintain stability. This requires a deep understanding of the local economic context and the ability to react quickly to change.

The Future Outlook: Trends and Opportunities

Looking ahead, the Russian tile and ceramic market is poised for continued transformation. Several key trends will define the competitive landscape of the next decade.

Surging Demand for Premium and High-Value Products

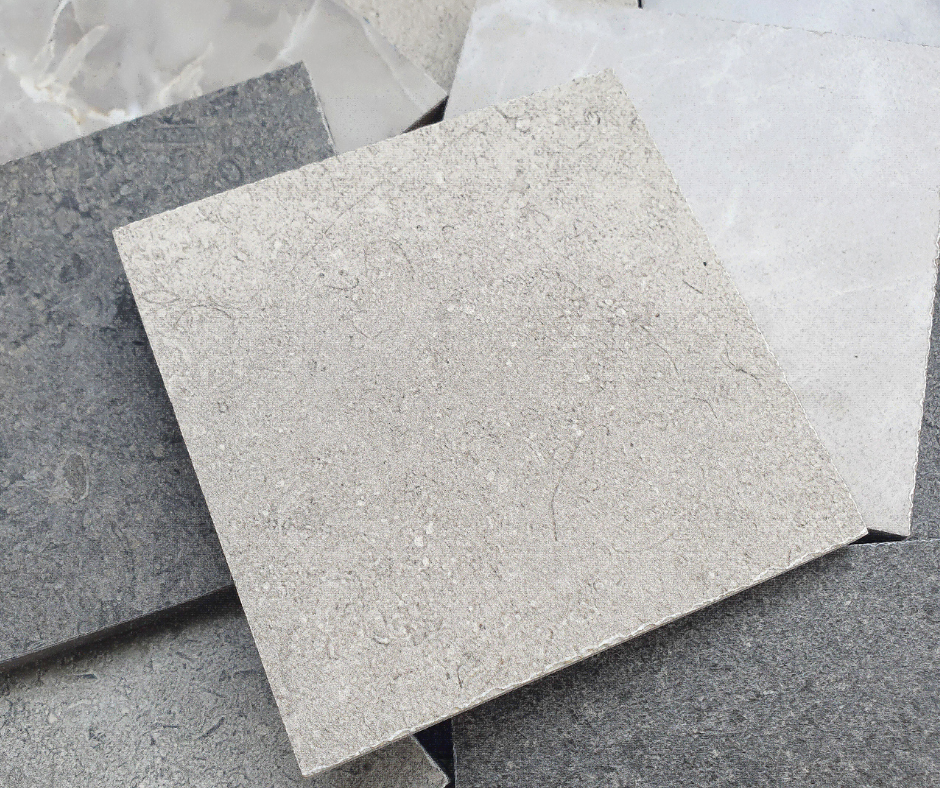

As the Russian middle class continues to grow, there will be a sustained shift towards higher-quality, design-oriented products. This means a rising demand for porcelain stoneware, large-format tiles, and materials with intricate finishes that mimic natural stone or wood. Companies that can meet this demand with a combination of quality, design, and a strong brand will gain a significant competitive edge.

The Rise of Sustainable and Eco-Friendly Materials

While still a nascent trend, environmental consciousness is growing among Russian consumers and developers. There is an emerging market for tiles made from recycled materials, produced using energy-efficient processes, or those certified for use in green building projects. Companies that can position themselves as leaders in sustainability will be well-placed to capture this future market share.

Urbanization and Regional Market Potential

While Moscow and St. Petersburg have been the traditional centers of demand, major regional cities like Kazan, Yekaterinburg, and Novosibirsk are experiencing their own construction booms. These secondary markets offer immense untapped potential for growth. A competitive strategy that includes a strong regional presence and a localized product mix will be essential for future success.

Conclusion

The Russian tile and ceramic market is a complex ecosystem of competition, where success is not guaranteed but earned through strategic foresight and operational excellence. It is a market where the strength of domestic production meets the innovation and branding of international imports. The key to winning lies in adaptability—the ability to harness cutting-edge technology, master a complex distribution network, and respond swiftly to the evolving tastes of the Russian consumer.

The future of this market is bright, driven by a resilient construction sector, a growing demand for premium products, and a slow but steady shift towards sustainability. For both local manufacturers and global exporters, the opportunities are immense, but only for those willing to engage in the strategic and fiercely competitive landscape that defines the Russian tile and ceramic industry.

نظرات ۰