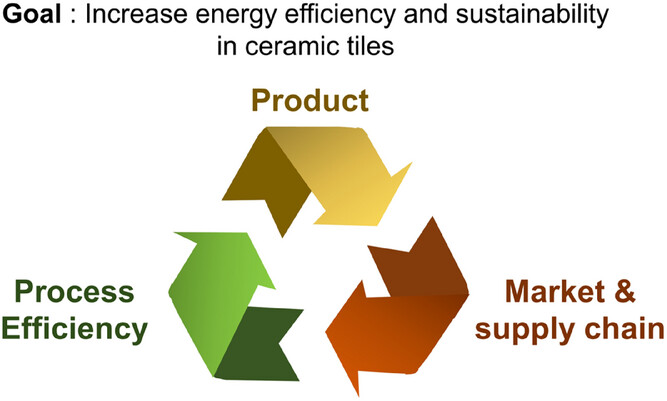

The global ceramic tile industry faces severe energy and infrastructure challenges. Discover data-driven solutions, 2025-2026 trends, and actionable strategies for a sustainable future.

The Hidden Cost Behind Every Square Meter

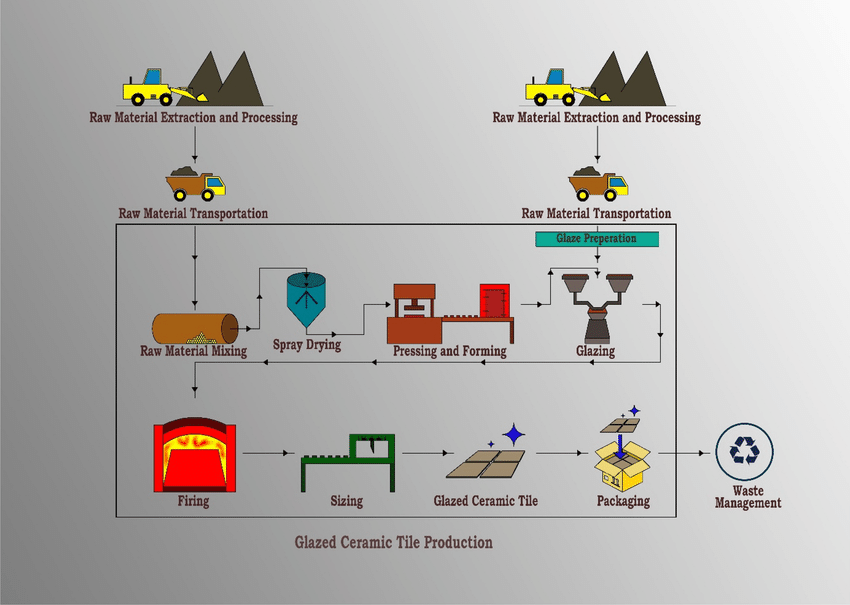

Imagine a single square meter of ceramic tile. Elegant, durable, and seemingly simple. Now, consider this: its production is responsible for approximately 14.4 kg of CO2 equivalent emissions, with the firing process alone consuming up to 55% of the total energy required in the entire manufacturing cycle . In a world where global production reached nearly 15 billion square meters in 2024, despite a 6.2% year-on-year decline, the scale of this energy-intensive challenge is staggering .

For manufacturers, architects, and policymakers, the core pain point is clear: how can an industry so vital to global construction remain economically viable and environmentally responsible amidst soaring energy costs, aging infrastructure, and tightening regulations? The struggle is real. From Spain, where 90% of the sector’s energy comes from gas, to emerging markets grappling with unreliable power grids, the pressure is mounting .

This article cuts through the noise to deliver a comprehensive, data-rich analysis of the energy and infrastructure challenges facing the ceramic tile industry. We will dissect the latest statistics from 2024-2026, explore the root causes of inefficiency, and, most importantly, provide a clear roadmap of proven, actionable solutions. By the end, you will have a complete understanding of not just the problems, but the strategic opportunities for building a more resilient and sustainable future for this critical sector.

The Energy Conundrum: Fueling an Industry on a Precarious Foundation

The ceramic tile industry is fundamentally an energy-hungry enterprise. Thermal energy for drying and firing processes accounts for a massive portion of operational costs, estimated to be as high as 30% of the total production cost [[39]]. This heavy reliance creates a fragile economic model that is highly sensitive to energy price volatility and supply chain disruptions.

The Firing Process: The Heart of the Energy Drain

The kiln, the heart of any ceramic tile factory, is also its biggest energy consumer. The high-temperature sintering process, which vitrifies the clay body and glaze, is incredibly demanding. On average, the thermal energy consumption for producing a fired tile is around 1,28 kWh per kilogram [[31]]. This process is so central that any inefficiency here cascades through the entire operation, inflating costs and environmental impact.

The primary fuel source remains natural gas, prized for its clean burn and controllability. However, this dependence has become a significant vulnerability. Geopolitical instability and market fluctuations can lead to sudden price spikes, directly threatening profit margins. For instance, the Spanish tile sector’s near-total reliance on gas (90%) leaves it exposed to these external shocks .

Regulatory Pressure and the Push for Efficiency

Governments and international bodies are responding to the industry’s carbon footprint with increasingly stringent regulations. The European Union’s “Ceramic Roadmap to 2050” is a prime example, setting ambitious targets for energy efficiency and minimal energy leakage across all ceramic products [[38]]. Similar pressures are mounting globally, forcing manufacturers to either innovate or face obsolescence.

These regulations are not just about compliance; they are a powerful market signal. Architects and large-scale developers are increasingly demanding Environmental Product Declarations (EPDs) and prioritizing suppliers with demonstrable sustainability credentials. A manufacturer unable to provide this data risks losing major contracts.

People Also Ask: What is the biggest source of energy waste in tile production?

The answer lies in the exhaust. A significant amount of thermal energy—often between 20% to 30%—is lost as hot flue gases exit the kiln [[46]]. This represents a massive, untapped resource. Historically, this waste heat was simply vented into the atmosphere, a practice that is no longer economically or environmentally tenable.

—

Infrastructure Challenges: The Crumbling Backbone of Production

Beyond energy, the physical and operational infrastructure of many ceramic tile plants is a critical bottleneck. Aging machinery, inefficient layouts, and outdated control systems create a perfect storm of waste, inconsistency, and high maintenance costs.

Aging Machinery and the Innovation Gap

Many factories, particularly in established markets, operate with machinery that is decades old. While robust, this equipment lacks the precision, automation, and energy-monitoring capabilities of modern systems. An old press might create tiles with inconsistent density, leading to higher breakage rates in the kiln. An outdated dryer may use far more energy than necessary to achieve the same moisture content.

This “innovation gap” puts these manufacturers at a severe competitive disadvantage. They cannot match the quality consistency, production speed, or cost-efficiency of competitors who have invested in new technology. The result is a race to the bottom on price, which further starves them of the capital needed for reinvestment—a vicious cycle.

Supply Chain and Logistics Vulnerabilities

The industry’s health is also tied to its upstream and downstream partners. Volatility in the price and quality of raw materials like feldspar, kaolin, and quartz can disrupt production schedules and affect final product quality . On the logistics side, the weight and fragility of ceramic tiles make transportation a significant cost factor. Inefficient port facilities, poor road networks, or complex customs procedures can add days to delivery times and increase the risk of damage, eroding customer satisfaction and profitability.

People Also Ask: How does infrastructure affect product quality?

Directly and profoundly. For example, a poorly maintained mold in the pressing stage can cause uneven pressure distribution, leading to internal stresses in the green tile body. These stresses often manifest as cracks during the high-heat firing process, creating costly waste. Similarly, an inconsistent temperature profile in an old kiln can result in tiles with varying degrees of vitrification, leading to a final product batch with non-uniform strength, color, or size.

—

Innovative Solutions: Turning Challenges into Competitive Advantages

The path forward is not about incremental change but a fundamental rethinking of energy use and infrastructure. The good news is that a suite of mature, commercially viable technologies and strategies is available today.

Waste Heat Recovery: Capturing Lost Value

One of the most impactful and immediate solutions is the implementation of waste heat recovery (WHR) systems. These systems capture the hot exhaust gases from the kiln’s cooling zone and repurpose that thermal energy for other processes within the plant.

Pre-drying Raw Materials: The recovered heat can be used to pre-dry the clay slurry before it enters the main spray dryer, significantly reducing the energy needed in that stage.

Heating Workshops: In colder climates, the recovered heat can be used to maintain comfortable temperatures in factory buildings, eliminating the need for separate heating systems.

Power Generation: Advanced systems, such as those using an Organic Rankine Cycle (ORC), can even convert a portion of the waste heat into electricity to power auxiliary equipment.

Companies like SACMI offer integrated WHR solutions that are managed by sophisticated software to ensure optimal performance and maximum energy savings .

Smart Manufacturing and Digital Twins

The integration of Industrial Internet of Things (IIoT) sensors and Artificial Intelligence (AI) is revolutionizing plant management. By placing sensors throughout the production line—from the raw material silos to the kiln and packaging—manufacturers can collect real-time data on every parameter.

This data can be fed into a “digital twin,” a virtual replica of the physical plant. Engineers can use this model to simulate changes, predict maintenance needs before a breakdown occurs, and continuously optimize the firing curve for maximum energy efficiency and product quality. This level of control was unimaginable a decade ago but is now a key differentiator for leading producers.

Sustainable Material Innovation

The industry is also looking upstream to reduce its environmental burden. Research is focused on:

Alternative Raw Materials: Using industrial by-products like fly ash or recycled glass (cullet) to partially replace virgin materials, reducing the need for mining and lowering the overall sintering temperature.

Thinner Tiles: Developing high-strength, ultra-thin tiles that use less raw material and require less energy to fire, without compromising on durability or aesthetics.

People Also Ask: Are there successful examples of these solutions in action?

Absolutely. Major global players are leading the charge. Mosa, a Dutch manufacturer, has invested in a new, highly energy-efficient kiln that drastically cuts both energy consumption and associated emissions. In India’s Morbi ceramic cluster, a large-scale project has been implemented to install waste heat recovery systems on roller kilns, demonstrating significant energy savings and a strong return on investment. These are not theoretical concepts; they are proven, working models for a sustainable future.

Conclusion: Building a Resilient and Sustainable Future

The challenges of energy and infrastructure in the ceramic tile industry are formidable, but they are not insurmountable. The data from 2024-2026 paints a clear picture: the status quo is a path to decline. However, embedded within these challenges are immense opportunities for innovation, differentiation, and long-term resilience.

To recap, the key takeaways are:

* The firing process is the epicenter of energy consumption and must be the primary focus for efficiency gains.

* Aging infrastructure is a silent killer of profitability and quality, demanding strategic investment.

* Waste heat recovery is a low-hanging fruit that offers immediate and substantial returns.

* Digitalization through IIoT and AI is no longer optional but a core requirement for modern, competitive manufacturing.

Looking ahead, the future belongs to manufacturers who view sustainability not as a cost center, but as a strategic asset. Those who invest in smart, efficient infrastructure and embrace a circular economy mindset will be the ones to thrive in an increasingly eco-conscious global market.

For a detailed assessment of your facility’s energy efficiency potential and a customized roadmap for implementing these advanced solutions, contact our team of industry experts today.

نظرات ۰