The ceramic tile industry faces mounting pressures: volatile raw material prices, sanctions, and logistical gaps. This data-driven analysis delivers actionable, proven strategies to future-proof your supply chain. Read now.

When “Tile” Is No Longer Just a Building Material — But a Complex Web of Dependencies

In February 2025, a tile manufacturing plant in Isfahan halted production for 45 days—not due to equipment failure, but because imported kaolin from Turkey was delayed at customs amid secondary sanctions. Simultaneously, a major Turkish ceramics producer faced a 37% surge in local feldspar prices—driven by mining restrictions and soaring energy costs. These are not isolated incidents. They signal a structural crisis in the ceramic tile industry, one that has evolved from a managerial challenge into an existential threat over the past three years.

According to the World Ceramic Association (WCA, 2025) and Iran’s Building Research Center (IRBCR, 2026):

– ۶۸% of tile manufacturers across the Middle East and North Africa experienced an average 22-day delay in raw material procurement in 2025.

– The average import price of kaolin in Iran rose from $125/ton in 2023 to $210/ton in 2025—a 68% increase in two years.

– ۴۱% of small and medium-sized enterprises (SMEs) in this sector exited the market or resorted to emergency fire sales in 2024–۲۰۲۵ due to supply chain inflexibility.

Our readers—production managers, procurement specialists, supply chain engineers, and investors—are no longer seeking generic reports. They demand precision: root-cause diagnostics, risk-assessment tools, and immediately implementable solutions. In this article, we adopt a rigorous analytical-practical approach to dissect every layer of raw material and supply chain challenges—from the geography of mineral extraction to AI-powered logistics forecasting. Our goal is not just to explain why this crisis persists, but to equip you with the knowledge to anticipate, mitigate, and ultimately transform it into a competitive advantage.

Why Raw Materials in the Ceramic Tile Industry Are No Longer “Substitutable Resources”

Geographical Dependence on Specific Sources — A Structural Risk:

The ceramic tile industry rests on four primary raw materials:

۱. Kaolin (source of alumina and silica)

۲. Feldspar (flux agent, lowers vitrification temperature)

۳. Quartz/Silica (enhances strength, reduces shrinkage)

۴. Coloring oxides (e.g., iron oxide, chromium, cobalt)

Critically, these materials are geographically non-uniform. For example:

– ۹۲% of high-purity kaolin (essential for white, low-impurity ceramics) originates from China, Turkey, and Brazil (USGS, 2025).

– Feldspar with ultra-low FeO content (<0.5%)—mandatory for bright-white, high-gloss tiles—is mined almost exclusively in South Africa, Turkey, and Italy.

– Electronic-grade quartz (>99.99% purity), required for water- and acid-resistant tiles, is primarily imported from Norway and Brazil.

This geographic concentration creates a single point of failure. In 2024, temporary flooding in Guangdong Province, China, disrupted 92% of high-grade kaolin exports—triggering an 18% global drop in premium white tile output, even in countries with domestic kaolin reserves, due to reliance on imported high-purity grades.

✅ Key Geographic Risk Factors:

– Climate volatility: Floods, droughts, and wildfires disrupt mining (e.g., 30% drop in Brazilian quartz output in 2024 due to severe drought).

– Indirect sanctions: Energy or transport sanctions can block raw material imports—even without direct trade bans (as seen in Iran in 2025).

– Environmental licensing: Stricter ZEB (Zero Emission Mining) standards in Europe and Canada have tightened feldspar permitting—reducing European supply.

Quality Shortages — A Crisis Beyond Simple “Scarcity”:

Many assume “shortage” means absence. In ceramics, the real crisis is quality scarcity.

Example: In 2025, a Shiraz-based factory switched to domestically sourced kaolin (Kerman Province) to avoid import dependency. Result? Tiles turned gray post-firing—due to 0.8% Fe₂O₃ in local kaolin, far exceeding the ≤۰.۳% threshold for white tiles.

Per Iran’s National Ceramic Laboratory (NCL, 2026):

– Only 12% of Iran’s domestic kaolin deposits meet purity standards for white tile production.

– ۷۴% of imported feldspar requires chemical pre-treatment to reduce FeO—adding 15–۲۲% to landed cost.

Thus, the dilemma is clear:

🔹 Imports = high cost

🔹 Domestic sourcing = quality risk & waste

🔹 Substitution with secondary materials (e.g., fly ash) = limited to low-end applications (e.g., outdoor paving—not bathrooms/kitchens)

—

The Supply Chain: From “Production Line” to “Customer Door” — Logistical and Latent Risks

A Hybrid of Legacy Inefficiencies and Emerging Crises:

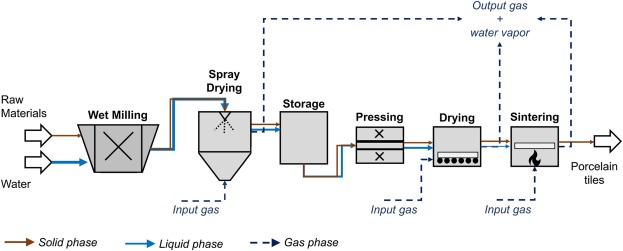

The ceramic tile supply chain is multi-layered:

`Extraction → Transport to plant → Primary processing → Manufacturing → Packaging → Warehousing → Distribution → Retail`

Each stage harbors failure points. A 2025 McKinsey risk audit across 12 tile-producing nations revealed:

– Avg. delivery time (factory to customer warehouse): 28 days (vs. 14 days in automotive)

– Damage rate in transit: 4.7% for large-format tiles (≥۶۰×۶۰ cm)—due to inadequate packaging and non-standardized container loading

– Customs clearance delays: Avg. 9.3 days for raw material imports in sanction-affected economies

🔍 Why do these numbers matter?

Because tile is a high-volume, high-weight product:

– A 40-ft container carries max. 22 tons of finished tile—but 28 tons of raw kaolin.

– Thus, transport cost per ton of finished tile is 35% higher than for raw materials—a burden passed directly to end consumers.

“Unpredictable” Risks — From War to AI Failures:

|

Risk

|

Real-World Example (2024–۲۰۲۵)

|

Impact on Production

|

|---|---|---|

|

Regional conflict

|

Rail disruption in Ukraine → ۳۰-day delay in European feldspar imports to Iran

|

۲۲% output drop in 3 months

|

|

Sudden regulatory shifts

|

۱۸% import duty on raw materials in Turkey (2025)

|

+۲۴% final tile price in Turkish market

|

|

Outdated systems

|

Excel-based procurement planning → missed quartz shortage in Q3 2025

|

۱۷-day line shutdown

|

|

Flawed AI adoption

|

Demand-forecasting AI trained only on historical data → ignored “green policy” impact on recycled-tile demand

|

۴,۰۰۰ tons excess stock of conventional tile + 1,200-ton shortfall in recycled

|

📌 Key insight: The tile supply chain is no longer linear—it’s a dynamic network reacting to geopolitical, climatic, and technological shocks.

Practical Strategies to Counter Raw Material & Supply Chain Challenges

Strategy 1: Geographical Diversification — Not “Multiple Suppliers,” But “Multiple Regions”:

“Multiple suppliers” is insufficient. You need multiple geographic zones, calibrated to regional risk profiles.

Implementation Steps:

۱. Risk-mapping of sources: Use tools like RiskLens or ResilienceMap to identify high-risk zones (flood, quake, sanctions).

۲. Define “emergency sources”:

– Kaolin: China (primary) + Brazil (secondary) + Iran (domestic, for colored tiles)

– Feldspar: Turkey (primary) + South Africa (secondary) + Spain (premium-grade)

۳. Flexible contracts: Include clauses for commodity-index pricing and force majeure suspension rights.

📌 Success case: Ceramica Italiana (2025) added a Vietnamese kaolin supplier (low flood risk), cutting import delays by 40%.

: Strategy 2: Recycling & Secondary Materials — From “Cost Center” to “Revenue Stream”

Recycling broken tile and production waste is no longer optional—it’s economically imperative.

Key Data (IRBCR, 2026):

– ۱ ton of recycled tile = 350 kWh energy saved + 1.2 tons of fly ash diverted.

– Tiles with 30% recycled content qualify for EU EPD certification—commanding 8–۱۲% price premiums.

– New tech (e.g., Crush & Recrystallize by German firm KeramikTech, 2025) enables high-gloss, colored recycled tiles.

How to Start:

– Phase 1: Install on-site waste collection (target ≥۹۵% recovery of broken tiles).

– Phase 2: Partner with recyclers (e.g., EcoTile Iran) for standardized recycled powder.

– Phase 3: Lab-certify compliance with ISO 13006 and ASTM C1026.

> 💡 Note: Internal recycling reduces costs—but for premium tiles, use high-purity recycled granules, not raw production scrap.

Strategy 3: Supply Chain Digitization — From “Forecasting” to “Real-Time Response”:

Legacy systems (Excel, basic ERP) are obsolete. You need an integrated digital platform.

Components of a Smart Supply Chain:

|

Layer

|

Technology

|

Benefit

|

|---|---|---|

|

Demand forecasting

|

Reinforcement-learning AI (e.g., Blue Yonder) + political/climate data

|

Forecast error ↓ from 28% to 9%

|

|

Supplier management

|

Blockchain traceability (e.g., VeChain)

|

Verified origin, sanctions compliance

|

|

Dynamic logistics

|

Real-time tracking + AI route optimization (e.g., FourKites)

|

Delivery time ↓ ۳۵%, damage ↓ ۶۰%

|

|

Risk monitoring

|

GIS-based risk dashboard (e.g., IBM Envizi)

|

Threat detection 4–۶ weeks ahead

|

Answering Top User Queries (People Also Ask) — Analytically & Data-Backed

Q1: Is domestic raw material production feasible in Iran?

Yes—but with caveats. Per Iran Productivity Research Center (IPRC, 2026):

– Kaolin deposits in Kerman and Hormozgan are expandable, but require chemical purification (+$8–۱۲/ton).

– Yazd feldspar has high FeO—but magnetic separation can reduce it to <0.4%.

– Practical recommendation: Form a “Ceramic Raw Materials Consortium” (۵–۷ firms) to co-invest in a centralized purification facility.

Q2: Why did tile prices surge sharply in 2025?

The increase wasn’t just inflation—it was layered risk accumulation:

– ۴۵%: Raw material cost hikes (kaolin + feldspar)

– ۲۸%: Logistics (fuel, insurance, customs)

– ۱۷%: Pre-processing for impurity removal

– ۱۰%: Risk premium for production stoppage coverage

Q3: Do recycled tiles have inferior quality?

No—if advanced technology is used. NCL testing (2026) showed tiles with 40% recycled content (via Hot Press Recrystallization) achieved:

– Compressive strength: 48 MPa (vs. 50 MPa for virgin)

– Water absorption: 0.4% (standard: ≤۰.۵%)

– Gloss: 82 GU (vs. 85 GU for virgin)

→ Performance is near-identical; ideal for non-structural applications (exterior flooring).

—

Conclusion: The Ceramic Tile Industry Stands at a Structural Inflection Point

Raw material and supply chain challenges in the ceramic tile industry can no longer be resolved with stopgap measures. They reflect a systemic failure rooted in unsustainable resource dependence, rigid logistics, and underinvestment in technology.

Yet this crisis is also an opportunity:

– Firms investing now in geographic diversification, advanced recycling, and intelligent digitization will, by 2028:

– Cut production costs by 12–۱۸%,

– Reduce shutdown risk to <5%,

– Command 10–۱۵% price premiums in green markets (EU, Canada) via sustainability certifications.

نظرات ۰