In the ever-evolving landscape of global trade, few sectors showcase the blend of tradition, innovation, and economic resilience quite like the ceramic tile industry. Iran, with its rich history of craftsmanship dating back centuries, has emerged as a powerhouse in ceramic tile production and export. Today, as we delve into the specifics of Iran’s ceramic tile exports to Pakistan, a remarkable story unfolds—one of substantial growth amid regional opportunities and challenges. Recent data highlights a 30% increase in these exports, signaling not just a boost in trade volumes but also a deepening economic tie between two neighboring nations in South Asia.

This surge is particularly noteworthy in the context of South Asia’s dynamic market, where rapid urbanization, population growth, and infrastructure development are driving unprecedented demand for building materials. Pakistan, with its population exceeding 230 million and a burgeoning construction sector, stands as a key player in this arena. The country’s real estate boom, coupled with government initiatives for affordable housing and commercial projects, has created a fertile ground for imported ceramic tiles that offer quality, affordability, and aesthetic variety.

![]()

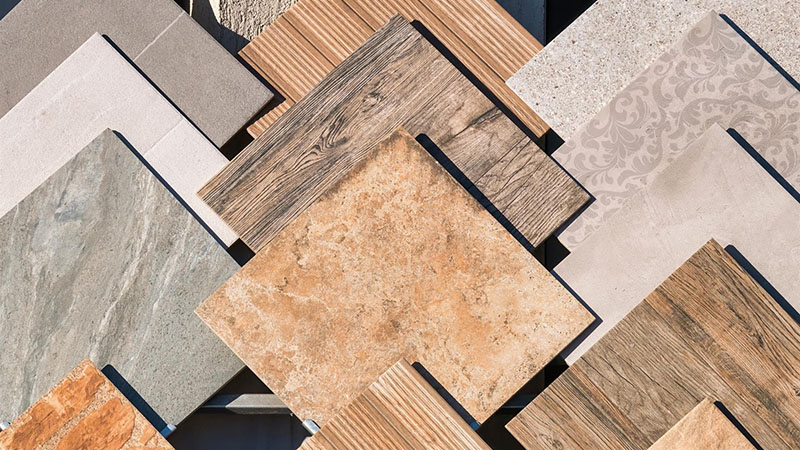

But why focus on Iranian ceramic tiles? These products are renowned for their durability, intricate designs inspired by Persian art, and competitive pricing, making them an ideal fit for Pakistani consumers ranging from homeowners to large-scale developers. This article explores the intricacies of this export trend, from production statistics and market demands to benefits, challenges, and future strategies. By understanding these elements, businesses, importers, and industry stakeholders can better navigate opportunities in the Iranian ceramic tiles export to Pakistan. Whether you’re an importer seeking reliable suppliers or a policymaker aiming to enhance bilateral trade, the insights here provide practical guidance grounded in current trends and data. As we proceed, we’ll uncover how this 30% growth is not just a statistic but a gateway to sustainable economic collaboration in the South Asian ceramic tile market.

Overview of Iran’s Ceramic Tile Industry

Iran’s ceramic tile industry is a cornerstone of the nation’s manufacturing sector, blending ancient artisanal techniques with modern industrial processes to produce world-class products. With an annual production capacity exceeding 720 million square meters, Iran ranks among the top global producers, exporting around 40% of its output to international markets. This industry employs thousands and contributes significantly to the country’s non-oil exports, helping diversify the economy away from petroleum dependency.

Production Statistics

In 2024, Iran’s ceramic tile market was valued at approximately USD 1.51 billion, with projections indicating a compound annual growth rate (CAGR) of 4.97% to reach USD 1.93 billion by 2030. This growth is fueled by abundant natural resources, such as high-quality clay and minerals, which are locally sourced, reducing production costs and enhancing competitiveness. Factories across provinces like Yazd and Isfahan utilize advanced technologies, including digital printing and nanotechnology, to create tiles that meet international standards like ISO 13006.

Export volumes tell a compelling story: In 2024, Iran exported ceramic tiles worth millions, with key destinations including neighboring countries in the Middle East and South Asia. Specifically, exports to South Asia have seen steady increases, driven by demand for floor and wall tiles in residential and commercial applications. The industry’s output includes a wide range: glazed and unglazed porcelain, ceramic mosaics, and large-format slabs, catering to diverse architectural needs. These statistics underscore Iran’s position as a top-5 global exporter, with exports reaching over 50 countries. For businesses eyeing the Iranian ceramic tiles market, these figures highlight a reliable supply chain capable of scaling to meet growing demands in regions like Pakistan.

Key Strengths

What sets Iranian ceramic tiles apart? First, their quality stems from rigorous manufacturing processes that ensure high density, low water absorption (below 0.5% for porcelain varieties), and resistance to scratches and stains. This durability makes them suitable for high-traffic areas, a critical factor in Pakistan’s humid and varied climate.

Second, affordability is a major strength. Iranian producers benefit from low energy costs and efficient supply chains, allowing tiles to be priced 20-30% lower than European counterparts without compromising quality. This pricing strategy has been pivotal in penetrating price-sensitive markets like Pakistan.

Third, design innovation draws from Persian heritage, offering intricate patterns, vibrant colors, and customizable options that appeal to cultural preferences in South Asia. From traditional motifs to modern minimalist styles, Iranian tiles provide versatility for interior designers and architects. Additionally, the industry’s focus on sustainability—using eco-friendly glazes and recycling water in production—aligns with global trends toward green building materials. For Pakistani importers, these strengths translate into products that not only enhance aesthetic appeal but also offer long-term value, reducing replacement costs and environmental impact.

The Pakistani Market for Ceramic Tiles

Pakistan’s ceramic tile market is experiencing robust growth, driven by urbanization and infrastructure investments. With a market size projected to expand significantly by 2031, it presents lucrative opportunities for exporters like Iran. The demand for ceramic tiles in Pakistan is multifaceted, encompassing residential renovations, commercial developments, and public projects.

Demand Trends in 2025

As of 2025, key trends in Pakistan’s ceramic tile demand include a shift toward sustainable and digitally printed tiles that mimic natural materials like wood and stone. Consumers are increasingly opting for large-format tiles (over 60×60 cm) for seamless installations in modern homes and offices. The rise of e-commerce has also influenced trends, with online platforms showcasing imported options, boosting awareness of Iranian products.

Urbanization rates, hovering around 3% annually, fuel demand in cities like Karachi and Lahore, where new housing schemes require durable flooring solutions. Government programs, such as the Naya Pakistan Housing Scheme, emphasize affordable materials, aligning perfectly with Iranian tiles’ cost-effectiveness. Moreover, post-pandemic hygiene concerns have increased preference for easy-to-clean ceramic surfaces. In 2025, trends also highlight eco-friendly tiles with low VOC emissions, catering to health-conscious buyers. For exporters, understanding these trends means tailoring shipments to include anti-bacterial and slip-resistant varieties, ensuring they meet local building codes and consumer preferences.

Market Size and Growth

The Pakistani ceramic tile market totaled around USD 39 million in 2024, with a 5% year-on-year increase. Projections for 2025-2031 indicate steady growth, driven by a CAGR of approximately 7%, mirroring global patterns where the Asia-Pacific region leads with a market worth USD 114.1 billion by 2030.

Imports play a vital role, with Iran contributing significantly—exports reached USD 1.57 million in 2024. This growth is supported by Pakistan’s construction boom, where residential sectors account for over 60% of tile consumption. Commercial segments, including hotels and malls, demand premium imports for aesthetic enhancement. Challenges like local production limitations (due to energy shortages) create gaps filled by imports, particularly from Iran via land borders. For stakeholders, this market size offers scalable opportunities, but success hinges on navigating tariffs and building strong distribution networks.

Export Dynamics from Iran to Pakistan

The export of ceramic tiles from Iran to Pakistan has gained momentum, with bilateral trade volumes reflecting stronger economic ties. This section examines the recent growth and underlying factors.

Recent Growth Figures

In recent years, Iran’s ceramic tile exports to Pakistan have surged by 30%, as highlighted in industry reports. From USD 1.57 million in 2024, projections suggest continued upward trajectory into 2025, driven by increased shipments of wall and floor tiles. This growth positions Pakistan as a top destination after Iraq, accounting for a notable share of Iran’s South Asian exports.

Volume-wise, exports include millions of square meters annually, with a focus on porcelain and ceramic varieties. The 30% increase aligns with broader trends in Iran’s tile exports, which saw stability despite global fluctuations. For practical purposes, this means Iranian exporters are ramping up production to meet Pakistani demand, often through direct shipments via the Taftan border.

Factors Driving the 30% Surge

Several factors contribute to this surge. Proximity reduces transportation costs, making Iranian tiles more competitive than those from distant suppliers like China or Spain. Trade agreements, including preferential tariffs under bilateral pacts, facilitate smoother exports.

Demand-side drivers include Pakistan’s infrastructure projects, where Iranian tiles’ quality addresses local shortages. Currency stability and barter trade mechanisms have also eased transactions, despite occasional hurdles. Additionally, marketing efforts by Iranian firms, such as participation in Pakistani trade fairs, have boosted visibility. The surge is further propelled by Iran’s production efficiencies, allowing for quick response to market needs. Businesses can leverage these factors by forging partnerships, ensuring compliance with Pakistani standards like PSQCA certifications.

Benefits of Iranian Ceramic Tiles for Pakistani Consumers

Iranian ceramic tiles offer tangible advantages to the Pakistani market, combining quality, cost, and cultural resonance.

Quality and Durability

Crafted from premium raw materials, Iranian tiles boast superior strength, with breaking moduli exceeding 35 N/mm² for porcelain types. This durability withstands Pakistan’s climatic extremes, from humid coasts to arid interiors, minimizing cracks and fading over time.

In practical terms, homeowners benefit from low maintenance—tiles resist stains and bacteria, ideal for kitchens and bathrooms. For commercial users, this translates to longer lifespans, reducing renovation costs. Certifications from bodies like Iran’s National Standards Organization ensure reliability, giving Pakistani buyers peace of mind.

Affordability and Variety

Priced competitively, Iranian tiles provide high value, often 15-25% cheaper than imports from Europe while matching quality. This affordability broadens access, from budget-conscious families to large projects.

Variety is another boon: Over 1,000 designs, sizes from 20×20 cm mosaics to 120×240 cm slabs, and finishes like matte or glossy cater to diverse tastes. Pakistani consumers can choose tiles that blend modern trends with traditional Islamic patterns, enhancing cultural fit.

Aesthetic Appeal

Inspired by Persian artistry, these tiles feature intricate geometrics and florals that resonate with South Asian aesthetics. Digital printing allows for realistic textures, mimicking marble or wood without the upkeep. For interior designers in Pakistan, this means versatile options for creating luxurious spaces affordably, elevating property values and user satisfaction.

Challenges in Exporting Tiles from Iran to Pakistan

Despite growth, exporters face hurdles that require strategic navigation.

Logistical and Trade Barriers

Border crossings like Taftan often experience delays due to customs procedures and infrastructure limitations. Transportation costs can escalate with fuel price fluctuations, impacting profitability.

Practical solutions include using bonded warehouses and digital tracking for shipments. Exporters must also comply with Pakistani import duties, which can reach 20% on certain tile categories.

Economic Sanctions and Regulations

International sanctions on Iran complicate banking and payments, leading to reliance on barter or third-party channels. This increases transaction times and risks.

To mitigate, exporters can utilize bilateral agreements and seek exemptions. Staying updated on regulations, such as anti-dumping laws, is crucial for smooth operations.

Competition and Market Penetration

Local Pakistani producers and imports from China pose stiff competition. Smuggling undermines legitimate trade, eroding market share.

Strategies involve branding Iranian tiles as premium yet affordable, through targeted marketing and partnerships with Pakistani distributors to build trust and loyalty.

Strategies for Enhancing Exports

To sustain and amplify the 30% growth, targeted strategies are essential.

Improving Trade Agreements

Enhancing bilateral pacts, like reducing tariffs on tiles, can boost volumes. Joint ventures for co-production could localize benefits, fostering long-term ties.

Exporters should advocate for streamlined customs via digital platforms, reducing clearance times from days to hours.

Marketing and Branding

Digital campaigns on platforms like Instagram and trade shows in Pakistan can highlight unique features. Building a strong brand narrative around heritage and quality differentiates Iranian tiles.

Collaborations with influencers and architects can demonstrate real-world applications, driving consumer preference.

Technological Advancements

Investing in R&D for innovative products, like solar-reflective tiles for Pakistan’s hot climate, can capture niche markets. Adopting AI in production enhances efficiency, lowering costs and improving customization.

Training programs for exporters on global standards ensure compliance, opening doors to expanded trade.

Conclusion

The 30% growth in Iran’s ceramic tile exports to Pakistan exemplifies the potential of regional trade in South Asia’s vibrant market. From Iran’s robust production capabilities to Pakistan’s escalating demand, this partnership offers mutual benefits—economic diversification for Iran and access to high-quality, affordable materials for Pakistan. We’ve explored the industry’s overview, market dynamics, benefits, challenges, and strategies, providing a comprehensive roadmap for stakeholders.

Looking ahead, sustaining this momentum requires addressing logistical and regulatory hurdles while leveraging strengths like quality and innovation. For importers, partnering with reliable Iranian suppliers can yield cost savings and product superiority. Policymakers should prioritize trade facilitation to unlock further growth. Ultimately, this export trend not only boosts economies but also fosters cultural exchange through shared appreciation for exquisite craftsmanship. As South Asia’s construction sector expands, Iranian ceramic tiles are poised to play a pivotal role, driving prosperity and collaboration. Businesses ready to engage will find ample opportunities in this thriving arena.

نظرات ۰