The global tile industry is undergoing a significant transformation as markets shift toward durable materials, contemporary aesthetics, and cost-efficient solutions. Across the African continent—particularly in South Africa—construction and home-renovation activities have accelerated, driven by urbanization, modernization, and the growth of both residential and commercial infrastructure. Within this dynamic landscape, Iranian porcelain and ceramic tiles have emerged as a competitive and attractive choice, gaining notable traction among wholesalers, architects, contractors, distributors, and retail buyers looking for high-value yet cost-efficient products.

This comprehensive market analysis explores the factors shaping tile demand in South Africa, the competitive advantages of Iranian tile manufacturers, the challenges exporters must consider, and the long-term opportunities for strategic expansion. Designed for business leaders, importers, and international trade professionals, this report provides an in-depth, practical perspective backed by market trends, buyer behavior, and industry insights.

Overview of South Africa’s Tile Market Landscape

Construction Growth and Urban Development

South Africa is in the midst of steady reconstruction and modernization. Major cities such as Johannesburg, Durban, and Cape Town continue to expand, and large-scale housing and tourism projects are increasingly common. This urbanization directly boosts tile consumption across:

- Residential flooring and wall coverings

- Commercial and hospitality developments

- Shopping centers and office towers

- Renovation of old buildings, a rapidly growing trend

As construction standards rise, buyers demand materials with higher durability, stronger quality control, and aesthetic consistency—all areas where Iranian porcelain and ceramic tiles excel.

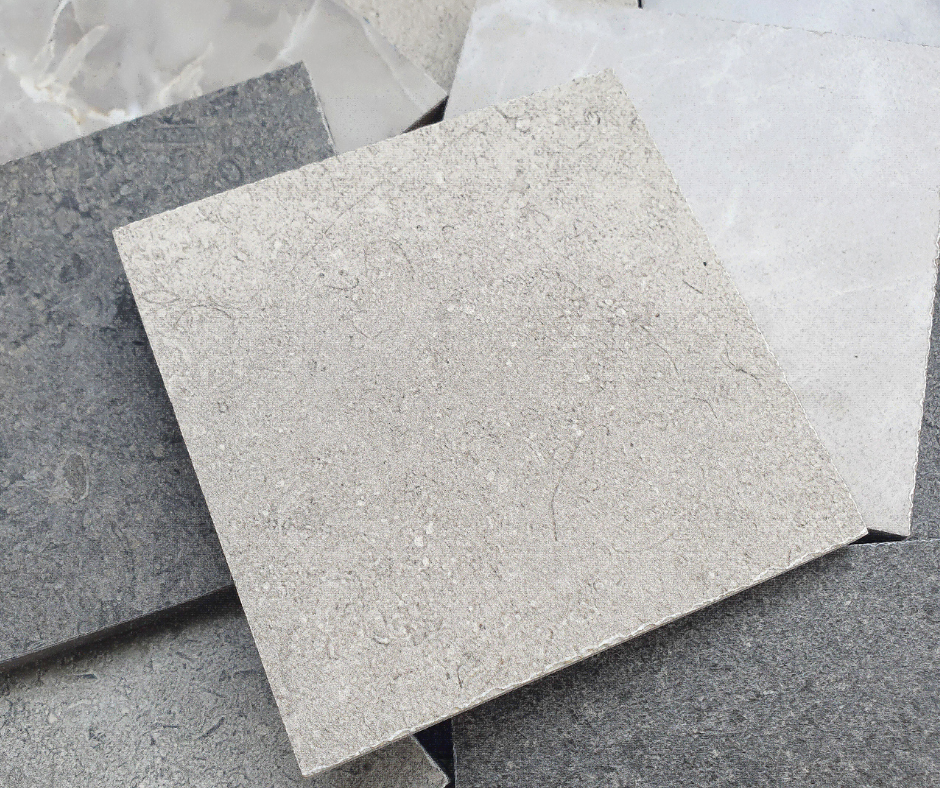

Increasing Popularity of Porcelain Tiles

Porcelain tiles have become a top choice in South Africa because they offer superior resistance to:

- Moisture

- Heavy traffic

- Stains

- Temperature fluctuations

South Africa’s climate—hot summers, humid coastal regions, and temperature variability—makes porcelain a highly effective solution for both indoor and outdoor spaces. Iranian producers supply porcelain tiles that meet global performance standards while maintaining competitive pricing, giving them an advantage against European and East Asian suppliers.

Why Iranian Tiles Are Gaining Attention in South Africa

Cost Efficiency Without Compromising Quality

One of the strongest competitive benefits of Iranian porcelain and ceramic tiles is the balance of premium quality with cost efficiency. Compared to Italian, Spanish, and even some Chinese products, Iranian tiles provide:

- Lower production and logistics costs

- Competitive FOB and CIF price ranges

- Reliable and consistent supply volumes

- High-end aesthetic design suitable for African markets

This combination makes Iranian tiles attractive for wholesalers aiming to maximize profit margins without reducing product quality.

Modern Technology and Manufacturing Excellence

Iran’s tile industry has heavily invested in modern technologies, including:

- Digital printing machinery

- Nano-glaze surface technology

- Thick-body porcelain production

- Slip-resistant and outdoor-rated finishes

These advancements allow manufacturers to produce collections aligned with South African taste trends—such as marble-look, cement-look, wood-look, matt finishes, and extra-large slabs.

Alignment with South African Design Trends

Interior design in South Africa is moving toward:

- Earthy colors (beige, brown, burnt clay)

- Luxury polished marble aesthetics

- Matte stone and terrazzo patterns

- Outdoor slip-resistant surfaces

Iranian factories already specialize in these styles, enabling exporters to fit market demand without needing additional production customization.

Key Tile Segments in Demand in South Africa

Porcelain Floor Tiles

Porcelain tiles are the most demanded product category due to durability and long-term value. Popular formats include:

- ۶۰۰×۶۰۰ mm

- ۶۰۰×۱۲۰۰ mm

- ۷۵۰×۱۵۰۰ mm

- ۸۰۰×۸۰۰ mm

Iranian manufacturers have strong capacity in these sizes, particularly in polished and matte finishes.

Ceramic Wall Tiles

Ceramic wall tiles remain essential for:

- Kitchens

- Bathrooms

- Retail and hospitality interiors

South African buyers often request light-colored designs, glossy finishes, and rectangular formats such as ۳۰×۶۰ cm and ۲۵×۷۵ cm.

Outdoor and Slip-Resistant Tiles

Outdoor tiles are increasingly popular due to:

- Expansion of patio living

- Growth in swimming pool and landscaping projects

- Commercial outdoor spaces

Iran’s anti-slip R10 and R11 tiles match local safety standards and are suitable for tropical or humid regions.

Competitive Landscape: Iran vs. Other Tile Exporting Countries

Iran vs. China

China dominates Africa’s tile import market, but Iranian tiles offer:

- Higher long-term durability

- More premium patterns

- Better quality consistency

- Reduced shipping disruptions due to shorter routes

For buyers seeking mid- to high-end quality, Iran is increasingly preferred.

Iran vs. Spain and Italy

European tiles lead in luxury design but at significantly higher prices. Iranian tiles offer:

- Comparable aesthetics

- Suitable technical standards

- Better affordability

This creates strong appeal for mid-market projects and wholesalers aiming for balanced value.

Iran vs. India

India provides competitive porcelain, but Iranian products often have:

- Stronger glaze resistance

- More natural stone appearances

- A smoother supply chain for Africa

- More cost-effective container pricing

Importing Tiles into South Africa: Requirements and Considerations

Certification and Compliance

To enter the South African market, imported tiles must meet:

- SABS (South African Bureau of Standards) regulations

- Slip resistance codes for outdoor tiles

- Water absorption classification

- Correct labeling and packaging documentation

Iranian factories accustomed to exporting to Europe, Russia, and GCC countries already follow similar compliance requirements.

Tariffs, Customs, and Import Duties

Although tile import duties exist, they remain manageable for exporters. Costs to consider include:

- Import duty (typically 20–۳۰%)

- VAT

- Customs clearing fees

- Port handling charges

Balanced pricing from Iranian factories still allows competitive market entry.

Shipping Routes and Logistics

Most exporters ship through:

- Bandar Abbas → Durban, South Africa

- Jebel Ali transit route for LCL shipments

- Occasional routes to Cape Town depending on demand

Transit times vary from ۱۸ to 32 days, significantly shorter than suppliers from East or West Asia, resulting in fresher supply and reduced inventory pressure.

Market Opportunities for Iranian Tile Exporters

Demand in Residential Housing Projects

Government-backed housing programs and private developments generate massive annual tile demand. Affordable, durable porcelain products fit perfectly into the requirements of mid- to large-scale housing projects.

Retail Showrooms and Tile Distributors

South Africa hosts a vibrant tile retail sector. Importers seek fresh designs with:

- Attractive packaging

- Competitive pricing

- Consistent supply ability

- Marketing support

Iranian exporters that provide catalogs, HD renderings, and ready marketing materials stand out among competitors.

Hospitality and Commercial Projects

Hotels, malls, and corporate offices increasingly prefer polished porcelain and high-end marble-look surfaces. Large-format Iranian tiles satisfy this segment due to:

- Elegant stone-inspired designs

- Technical durability

- Lower cost compared to European slabs

Exporting Branded and Private-Label Tiles

Many South African distributors prefer private-label tiles to strengthen their brand identity. Iranian factories can support:

- Customized cartons

- Unique collection names

- Project-specific colors

This level of flexibility increases market opportunities substantially.

Challenges and Solutions for Exporting to South Africa

Currency Fluctuations

The South African Rand is volatile, affecting importers’ purchasing power. Solutions include:

- Offering stable USD-based pricing

- Providing special seasonal discounts

- Supporting distributors with flexible order quantities

Market Education

Many buyers are more familiar with Chinese or Spanish tiles. Iranian exporters can overcome this by:

- Providing sample sets and mockups

- Sharing technical test reports

- Offering design suggestions for local architecture

Competition with Low-cost Products

The presence of extremely cheap alternatives is a challenge. Exporters can differentiate by highlighting:

- Longer lifespan

- Higher surface resistance

- Modern digital printing quality

Future Outlook: Will Demand for Iranian Tiles Continue to Grow?

Strong Long-Term Potential

Given South Africa’s projected expansion in construction, renovation, and commercial development, tile demand is expected to grow steadily through 2030. Iranian manufacturers, with their price-performance advantages, are positioned to become one of the leading suppliers in Africa.

Sustainability and Eco-Friendly Trends

South African designers increasingly prioritize sustainable materials. Iranian porcelain tiles—known for low water absorption and durability—fit these sustainability goals by reducing long-term replacement needs.

Rising Demand for Luxury Surfaces

High-income neighborhoods and commercial sectors are shifting toward sophisticated stone-look porcelain tiles. Iranian factories equipped with advanced digital printing systems can capture this premium market.

Conclusion

The demand for Iranian porcelain and ceramic tiles in South Africa is steadily rising due to the perfect combination of competitive pricing, high-end design, durability, and strong manufacturing capabilities. As construction and renovation projects continue across the country, buyers are actively searching for reliable suppliers that can offer both quality and consistency—making Iran one of the most strategic partners for the South African market.

For exporters, the opportunity is substantial. By understanding local market dynamics, complying with import regulations, supporting distributors, and offering designs that match South African trends, Iranian suppliers can significantly strengthen their presence in one of Africa’s fastest-growing tile markets.

نظرات ۰