A New Golden Era for Iranian Tiles in the Russian Market

The world of international trade is an ever-shifting landscape, but few corridors have seen a transformation as dramatic and promising as the Iran-Russia trade axis. As we navigate through the strategic and economic complexities of 2025, the Russian construction and interior design sectors are experiencing a significant, structural shift. This change is not just a fleeting trend; it’s a robust, sustained movement away from traditional European suppliers (like Italy and Spain) and a decisive pivot towards reliable, high-quality, and cost-effective alternatives. At the heart of this lucrative pivot lies the Iranian ceramic and porcelain tile industry—a sector poised for unprecedented growth.

For decades, Iranian craftsmanship has been synonymous with quality, durability, and a rich artistic heritage that resonates deeply with global consumers. Today, backed by strengthened strategic alliances, improved logistics along the International North-South Transport Corridor (INSTC), and a clear price-to-value advantage, Iranian tiles are set to dominate a substantial share of the $۲+ billion Russian tile market.

This article serves as your indispensable, ۲۰۲۵-focused blueprint for mastering this export journey. It is a comprehensive, practical guide designed for manufacturers, exporters, trade agencies, and investors looking to not only enter but profitably scale their operations in the vast Russian Federation. We will dissect the current market dynamics, unpack the critical logistical hurdles, detail the mandatory compliance requirements, and present a proven strategy for maximizing your success. This is more than a guide; it’s your roadmap to establishing a secure, successful, and enduring presence for your products in a high-demand market. Prepare to unlock the full potential of exporting high-quality Iranian tiles to Russia.

Part I: The 2025 Market Landscape – Why Russia Needs Iranian Tiles

The surge in demand for Iranian tiles within Russia is driven by a powerful confluence of geopolitical and domestic economic factors. Understanding these drivers is the first critical step in formulating a winning export strategy.

۱. The Post-Sanctions Supply Vacuum

The most defining factor in the 2025 market is the substantial supply vacuum created by ongoing geopolitical tensions and trade restrictions. Major European tile producers, which historically held a dominant share of the premium and mid-range Russian market, now face significant, often insurmountable, logistical and payment barriers.

- The Opportunity: Russian distributors, large construction firms, and high-end retail chains are actively seeking dependable, consistent suppliers who are not subject to these external constraints. Iranian manufacturers, with their non-aligned trade status and established, sanctioned-resilient payment systems (such as the MIR/Shetab link and barter arrangements), offer unparalleled reliability. This translates to an open door for Iranian products to fill the mid-to-high quality segments previously occupied by Spanish and Italian imports.

۲. Russia’s Booming Construction Sector and Infrastructure

Despite external economic pressures, Russia’s domestic construction sector remains robust, fueled by government-backed infrastructure projects, urbanization, and a sustained drive for new residential and commercial development.

- Residential Demand: The need for new, modern housing, particularly in major hubs like Moscow, St. Petersburg, and the rapidly developing regions of Siberia and the Urals, drives a massive, continuous demand for porcelain slabs, large-format tiles, and durable ceramic flooring.

- Commercial/Public Projects: Airports, metro stations, shopping centers, and government buildings require tiles with superior technical specifications, including high slip resistance, frost resistance (critical for the Russian climate), and exceptional durability. Iranian technical porcelain and specialized façade tiles are perfectly positioned to meet these stringent GOST standards.

۳. The Iranian Competitive Advantage: Quality, Price, and Aesthetics

Iran’s ceramic industry possesses inherent competitive strengths that directly address the Russian market’s core needs:

- Price Competitiveness: Abundant domestic raw materials (clay, silica), lower energy costs, and reduced labor expenses allow Iranian producers to offer premium-quality tiles at a 15-30% lower cost than comparable European or even Turkish imports. This superior price-to-value ratio is incredibly attractive to price-sensitive yet quality-focused Russian buyers.

- Production Scale and Modernity: Factories in key manufacturing zones (Yazd, Isfahan) are equipped with modern Italian and Spanish machinery, ensuring the production of tiles that adhere to international quality and design trends, including the popular wood-effect, marble-look, and minimalist large-format designs.

- Unique Designs (Persian Heritage): A subtle but powerful advantage lies in the artistic tradition. Tiles that subtly incorporate traditional Persian patterns and colors can successfully tap into niche high-end markets seeking unique, culturally rich interior finishes.

Part II: Logistics and Transport – The INSTC Revolution

Historically, one of the primary obstacles to exporting Iranian ceramic tiles to Russia was the costly and time-consuming logistics. The full operationalization of the International North-South Transport Corridor (INSTC) in 2025 has entirely redefined this challenge, turning a weakness into a major strategic advantage.

۱. Leveraging the INSTC for Speed and Cost Efficiency

The INSTC is a 7,200 km multi-modal network of ship, rail, and road routes that dramatically reduces transit time and cost.

- The Caspian Sea Corridor (Key Route): The most direct and critical route involves transport from Iranian factories (often via road) to Caspian ports like Anzali or Amirabad, followed by shipment to Russian ports such as Astrakhan or Olya.

- Time Savings: Traditional sea routes via the Suez Canal could take 45-60 days. The INSTC now cuts this to ۲۰-۲۵ days via a combination of road/rail and sea, significantly reducing lead times and improving inventory management for Russian importers.

- Azerbaijan/Armenia Rail and Road Corridors: For land-locked regions or specific logistical requirements, utilizing the transit capabilities through Azerbaijan and/or Armenia offers a reliable alternative, particularly for accessing markets in the Caucasus and Southern Russia. Armenia, as a member of the Eurasian Economic Union (EAEU), offers streamlined customs procedures for goods re-exported into Russia.

۲. Critical Logistical Best Practices

Logistical efficiency is not just about the route; it’s about execution. Mistakes here lead to costly damages, delays, and a loss of importer confidence.

- Packaging Excellence (The Russian Climate Factor): Given the harsh Russian winter climate and the long distances, packaging is non-negotiable. Tiles must be packed using:

- High-Density Styrofoam and Edge Protectors: To absorb shock and prevent chipping.

- Heat-Shrink Wrapping: To prevent moisture damage, especially critical during the Caspian Sea leg.

- Robust Crates/Pallets (Fumigated): Pallets must meet international standards (ISPM 15) and be strong enough for multi-modal handling.

- Choosing the Right Incoterms: For new exporters, offering CIF (Cost, Insurance, and Freight) to a major Russian port (like Astrakhan) can be appealing to buyers, as it simplifies their import process. However, as experience grows, transitioning to FCA (Free Carrier) or EXW (Ex Works) can better manage the exporter’s liability and costs.

- Engaging Specialized Freight Forwarders: Do not rely on general freight companies. Partner with Iranian and Russian logistics firms that have proven, daily experience with the INSTC, managing tile-specific cargo (which is heavy, fragile, and sensitive to vibration).

Part III: Regulatory Compliance and Payment Security

Navigating the regulatory environment is the most detail-oriented but crucial aspect of a successful Iran-Russia tile export operation in 2025. Non-compliance results in severe delays and penalties at the border.

۱. Mandatory Certification: The GOST Standard

Unlike many markets, the Russian Federation and the wider Eurasian Economic Union (EAEU) have strict mandatory quality and safety standards.

- Conformity Assessment (Declaration/Certificate): For almost all construction materials, including ceramic and porcelain tiles, a Certificate of Conformity (GOST-R or EAEU TR CU) is required. This certification proves that the tiles meet Russia’s safety, technical, and performance standards (e.g., frost resistance, fire safety, abrasion).

- Actionable Step: Engage a Russian-accredited certification body while the tiles are still in Iran. The testing process can be lengthy, and having the certificate in hand before the shipment leaves is essential for smooth customs clearance.

۲. Documentation Checklist (The “Golden Six”)

A flawless documentation package is the key to minimizing delays at the border. Ensure these six core documents are perfectly aligned with the contract and the physical shipment:

- Commercial Invoice: Detail the goods, price, Incoterm, and payment terms. Must match the Pro Forma Invoice.

- Packing List: Accurate details of gross/net weight, number of pallets, and box count.

- Certificate of Origin (CoO): Issued by the Iranian Chamber of Commerce, crucial for potentially benefiting from EAEU customs discounts.

- GOST/EAEU Certificate of Conformity: The mandatory quality certificate.

- Bill of Lading (B/L) or CMR (Road Waybill): The transport document.

- Insurance Certificate: Mandatory for covering the cargo risk.

۳. Secure Payment Mechanisms (Bypassing SWIFT)

The primary challenge in Iran-Russia trade is the exclusion from the SWIFT system. In 2025, several reliable alternatives have been operationalized:

- The MIR/Shetab Interbank Link: The most secure and increasingly used method is the direct linkage between Russia’s MIR and Iran’s Shetab interbank messaging systems. This allows for direct, transparent, and regulated payments in national currencies (Rial/Ruble), bypassing international scrutiny.

- Barter and Offset Arrangements: For large-volume transactions, sophisticated barter and offset arrangements, often involving the counter-export of Russian goods (e.g., grain, machinery) to Iran, are common. This requires working with specialized trading houses.

- Third-Party Banking (Strategic): Utilizing trusted banks in non-aligned jurisdictions (e.g., in the EAEU region) for temporary funds holding is a cautious approach, though the MIR/Shetab link is quickly becoming the preferred method.

Part IV: Marketing and Sales Strategy for Russian Consumers

The Russian market is sophisticated and has specific aesthetic preferences. A generic international marketing approach will fail. Your sales strategy must be localized and targeted.

۱. Aesthetic and Technical Preferences

The Russian buyer is highly discerning, valuing both appearance and technical performance.

- Style Trends (The “Affordable Luxury” Niche):

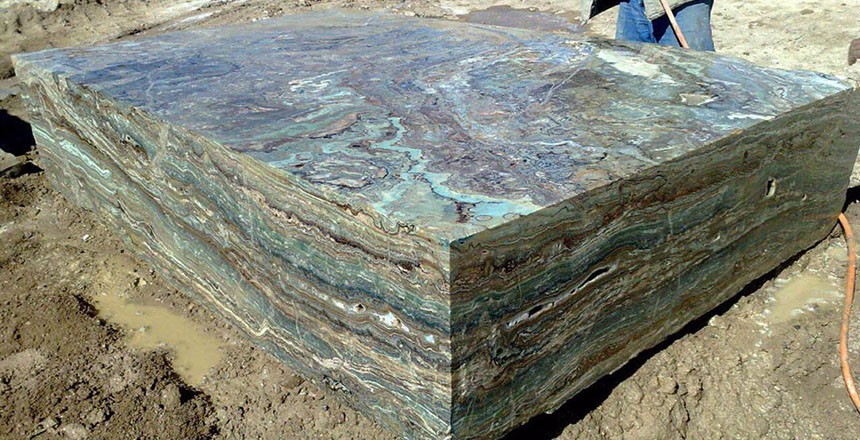

- Large Format & Porcelain Slabs: High demand for large tiles (e.g., $۶۰ \times 120$ cm, $۸۰ \times 80$ cm, and $۱۰۰ \times 300$ cm slabs) for luxury flooring and wall cladding, often with a high-gloss or polished finish.

- Aesthetic Focus: Strong preference for realistic natural stone looks (marble, granite, onyx) and sophisticated wood-effect tiles for residential spaces.

- Technical Focus (The Cold Climate Imperative):

- Frost Resistance: Absolutely mandatory for external applications (façades, balconies) and highly valued for unheated interior spaces.

- High Abrasion Resistance (PEI IV/V): Essential for commercial and high-traffic residential areas.

- Slip Resistance (R Rating): Critical for wet areas (bathrooms, kitchens, pools), often requiring a higher $\text{R}10$ or $\text{R}11$ rating.

۲. The Go-To-Market Strategy

Your distribution and sales channels must be tailored to the Russian market structure.

- Targeting Importers and Distributors (Bulk Sales): The fastest and most scalable entry is to partner with established Russian importers who have existing distribution networks to wholesalers, retailers, and large construction project managers. They handle the inventory, marketing, and logistics within Russia.

- Direct Engagement: Trade Fairs: Participation in major Russian building and design expos, particularly MosBuild and YugBuild, is non-negotiable. These events are where serious buyers, architects, and project managers source new suppliers. Use this platform to showcase your technical specifications and unique designs.

- Digital Presence and Localization (Yandex SEO): While Google is used, the dominant search engine in Russia is Yandex. Your digital strategy must include:

- Russian Language Website: A professional website with high-quality images and full technical specifications translated into Russian.

- Yandex SEO and Advertising: Optimization for Russian-language keywords (e.g., иранская плитка, купить керамогранит оптом).

- Product Catalogs: Digital catalogs must feature local Russian pricing (in Rubles) and clear conversion tables for square meters.

Part V: Major Challenges and Risk Mitigation

While the opportunity is vast, success in the Russian market requires a sober assessment and mitigation of inherent risks.

۱. Currency and Payment Risk

The fluctuation of the Iranian Rial (IRR) and the Russian Ruble (RUB) poses a persistent risk to profitability.

- Mitigation: Insist on contracts priced in a stable third-party currency (e.g., Euro or USD) or utilize forward exchange rate contracts with banks to hedge against volatility when dealing in national currencies. Factor in a conservative buffer for exchange rate fluctuations in your pricing model.

۲. Quality Control and Consistency

The Russian market, having been exposed to high-end European products, has a low tolerance for defects. A single container of substandard quality can ruin a long-term relationship.

- Mitigation: Implement a stringent, third-party pre-shipment inspection (PSI) process. Employ an international quality control agency to conduct final checks on dimensional accuracy, shade variation, packaging, and technical specifications before the goods are sealed for export. Consistency is the ultimate competitive advantage.

۳. Customs and Bureaucracy

Russian customs clearance can be notoriously complex and slow without professional support.

- Mitigation: Do not attempt to manage customs in Russia without a local, experienced Customs Broker. This professional (often retained by the importer but sometimes paid for by the exporter) will ensure all paperwork is filed correctly, duty/tax payments are accurate, and the shipment is cleared swiftly, minimizing demurrage charges at the port.

Conclusion: Paving the Way for Long-Term Success

The export of Iranian ceramic and porcelain tiles to the Russian Federation in 2025 represents more than a short-term market opportunity—it is a strategic, high-growth endeavor underpinned by favorable geopolitical alliances and a massive, underserved demand. The foundation for success rests on three core pillars: Logistical Mastery via the INSTC, Rigorous Regulatory Compliance (GOST), and a Localized, Quality-Focused Marketing Strategy.

The current market environment offers a rare window for Iranian producers to move beyond regional trade and establish themselves as the preeminent, dependable source of high-quality, aesthetically pleasing, and technically superior tiles in one of the world’s largest construction markets. By utilizing this 2025 Blueprint—focusing on exceptional packaging, securing the mandatory certifications, leveraging the MIR/Shetab payment system, and aligning your designs with Russian consumer preferences—your enterprise can not only capture but sustain a dominant and highly profitable market share for the coming decade. The opportunity is open; the time for decisive action is now.

نظرات ۰