The Russian Federation, a vast and complex market, presents a unique landscape for the global tile and ceramic industry. Far more than just a destination for construction materials, Russia’s market is a dynamic interplay of deep-seated cultural preferences, evolving economic conditions, and unique geopolitical factors. For international manufacturers, distributors, and investors, understanding this market requires more than just analyzing sales figures; it demands a nuanced appreciation of the forces that shape consumer demand and industry operations.

This comprehensive guide takes a deep dive into the Russian tile and ceramic sector, exploring the critical economic pillars that support it and the intricate cultural factors that define its aesthetic and functional demands. We’ll uncover the key trends, examine the challenges posed by a volatile market, and identify the strategic opportunities waiting to be unlocked. Whether you’re a seasoned industry veteran or looking to make your first move into this promising yet complex territory, this article will provide you with the insights needed to navigate the Russian market with confidence and success.

The Economic Landscape: Pillars of the Russian Tile and Ceramic Market

The Russian tile and ceramic market is a robust, multi-billion-dollar industry driven by significant domestic production and substantial imports. Its performance is intrinsically linked to the broader macroeconomic health of the country, particularly the construction and real estate sectors.

Market Size and Growth Trajectory

For years, the Russian market has been one of the largest in Europe. Its growth has been primarily fueled by a continuous demand for new residential and commercial construction, as well as a large-scale renovation and remodeling market. Urbanization plays a crucial role; as more of the population moves to cities, the need for new housing and infrastructure increases, directly stimulating demand for building materials like ceramic and porcelain tiles.

Historically, the market has shown resilience, but it is not immune to economic volatility. Fluctuations in oil prices, ruble devaluation, and international sanctions have, at times, impacted consumer purchasing power and investment in construction projects. Despite these challenges, the long-term trend remains positive, driven by state-backed initiatives for housing development and infrastructure modernization. Domestic production has been a key area of focus for the government, with policies aimed at reducing reliance on imports and boosting local manufacturing capacity.

Domestic Production vs. Imports: A Delicate Balance

The Russian ceramic industry has a strong domestic base, with numerous large-scale manufacturers operating across the country. These local producers often benefit from lower production costs and a deep understanding of local consumer preferences. They typically dominate the lower-to-mid-range segments, offering affordable and functional products that cater to the mass market.

However, imports remain a critical component, particularly in the premium and specialty segments. Italy, Spain, and China are historically the top suppliers, each bringing a different value proposition. Italian and Spanish tiles are highly sought after for their superior design, quality, and aesthetic appeal, often associated with luxury and European style. Chinese tiles, on the other hand, compete primarily on price, offering a more affordable option for budget-conscious projects. Recent geopolitical shifts and sanctions have complicated supply chains, leading to a reorientation of trade flows and an increased focus on alternative suppliers from countries less affected by restrictions. This has also accelerated the trend of import substitution, as domestic producers seek to fill the gap left by traditional European suppliers.

Key Economic Drivers and Sectoral Demand

The performance of the market is directly influenced by several economic drivers:

- Residential Construction: This is the single largest driver of demand. New housing projects, from large apartment complexes to private homes, create a constant need for millions of square meters of floor and wall tiles. The ongoing modernization of existing housing stock, including countless Soviet-era apartments, also contributes significantly to the renovation market.

- Commercial and Public Projects: The development of new office buildings, shopping centers, hotels, and public infrastructure projects (like metro stations and airports) represents a significant source of demand, particularly for high-performance and aesthetically appealing porcelain stoneware.

- Consumer Purchasing Power: The overall economic well-being of the population dictates their spending on home improvements. When the ruble is strong and wages are stable, consumers are more likely to invest in higher-quality, more expensive imported tiles. Conversely, economic downturns tend to push consumers towards more affordable, domestically produced options.

- Government Policies: State-backed programs for housing construction, mortgage subsidies, and infrastructure investment directly stimulate the tile market. Government support for domestic manufacturing through subsidies or tax incentives also shapes the competitive landscape.

Cultural and Social Dimensions Shaping Demand

Beyond the numbers, the Russian tile market is profoundly shaped by unique cultural values, aesthetic sensibilities, and historical influences. Understanding these factors is crucial for any brand aiming to connect with Russian consumers.

Architectural and Interior Design Trends

Russian interior design is a fascinating blend of tradition and modernity. While classic and neoclassical styles remain popular, especially in more traditional or luxury settings, there is a growing demand for contemporary, minimalist, and Scandinavian-inspired designs.

- The Neoclassical Aesthetic: Characterized by its use of rich materials, ornate patterns, and grand scales, this style often favors natural stone-look porcelain tiles, marble-effect surfaces, and intricate mosaic patterns, particularly in kitchens, bathrooms, and hallways of more upscale homes.

- Modern and Minimalist: A rapidly growing segment, driven by younger urban populations. This style prioritizes clean lines, simple forms, and neutral color palettes. Large-format tiles in shades of gray, beige, and white are highly popular, as they create a sense of spaciousness and understated elegance. Concrete-look and wood-look tiles are also gaining immense popularity for their ability to blend modern aesthetics with a natural, cozy feel.

Consumer Preferences and Habits

Russian consumers are discerning and value-conscious, often balancing quality, durability, and aesthetics.

- Durability and Practicality: The harsh Russian climate, with its freezing winters and dramatic temperature swings, makes durability a top priority. Frost-resistant and highly durable porcelain stoneware is the preferred choice for outdoor areas, balconies, and even high-traffic indoor spaces. Consumers also value scratch-resistant and easy-to-clean surfaces.

- Aesthetics and Design: While practicality is key, design is not an afterthought. Russians are increasingly exposed to global trends through the internet and travel, and they demand a wide variety of design options. They are willing to invest in tiles that reflect their personal style and create a unique atmosphere in their homes.

- The Price-Value Proposition: Unlike some Western markets where brand loyalty can be a dominant factor, Russian consumers often make their purchasing decisions based on the best balance of price and perceived quality. They will extensively compare options and seek out products that offer the most value for their money. Imported tiles are often seen as a sign of prestige and quality, but domestic manufacturers are catching up fast by offering similar designs at more competitive prices.

The Role of Tradition and Aesthetics

The rich history of Russian art and architecture also subtly influences modern tile trends. The use of intricate patterns and vibrant colors, reminiscent of traditional Russian folk art and imperial palaces, still finds its way into contemporary design. This can be seen in decorative tile inserts, intricate mosaic patterns, and the continued popularity of bold, geometric designs in public spaces and a certain segment of the residential market.

Market Segments and Key Product Categories

The Russian tile market is segmented by product type, with some categories experiencing explosive growth.

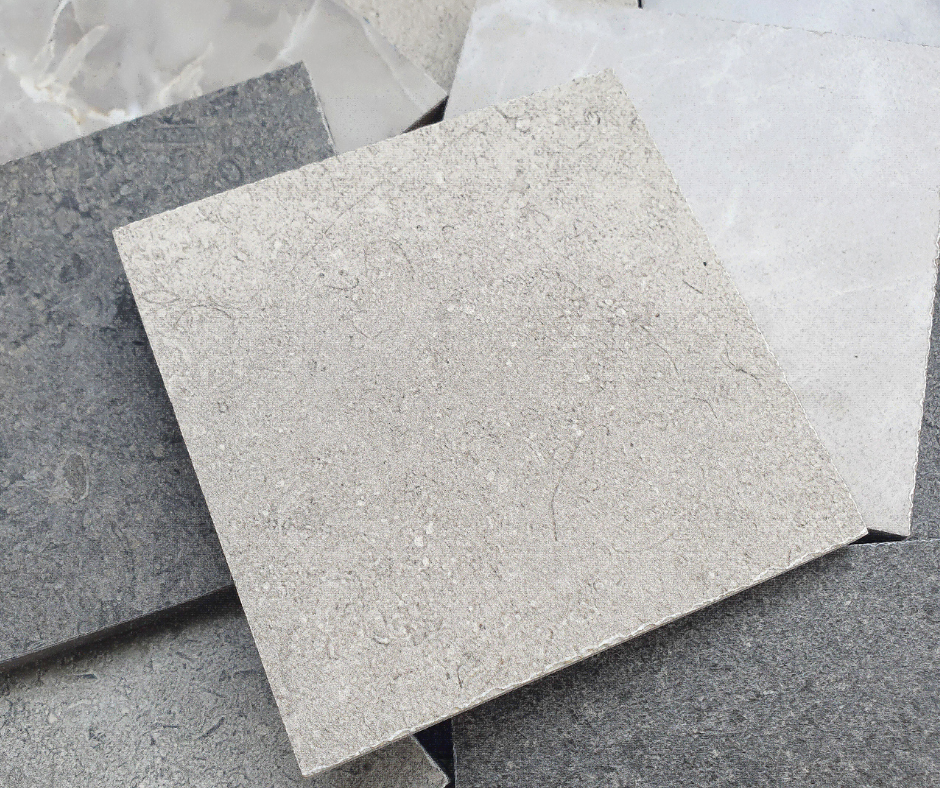

Porcelain Stoneware: The Dominant Player

Porcelain stoneware (also known as porcelain tiles) is, without a doubt, the king of the Russian market. Its popularity is driven by its exceptional durability, low water absorption, and frost resistance, making it an ideal choice for both indoor and outdoor applications in Russia’s challenging climate. Large-format porcelain stoneware is particularly in vogue, used to create seamless, monolithic surfaces in modern interiors. This material is used extensively for floors in both residential and commercial projects.

Wall and Floor Tiles

While porcelain stoneware dominates flooring, wall tiles remain a crucial category, particularly for bathrooms and kitchens. Ceramic wall tiles in smaller formats are still a staple for their ease of installation and cost-effectiveness. In terms of design, glossy, subway-style tiles are popular for a classic look, while matte finishes and geometric patterns are gaining traction for a more contemporary feel.

Mosaics and Decorative Tiles

While a smaller segment, the demand for mosaics and decorative tiles is growing, driven by a desire for personalization and unique design accents. Mosaics are often used to create feature walls, decorative borders, or stunning backsplashes. This category also includes artisanal and handcrafted tiles, which cater to a niche market of consumers looking for bespoke, high-end solutions.

Challenges and Opportunities for Market Players

The Russian market is full of potential, but it is not without its significant challenges, especially in the current geopolitical climate.

Navigating Geopolitical Risks and Sanctions

The ongoing geopolitical situation and resulting sanctions pose the most significant challenge. Sanctions can disrupt supply chains, restrict financial transactions, and create uncertainty for foreign investors. This has led many international companies to reassess their presence in the market, while simultaneously creating new opportunities for domestic producers and suppliers from countries like Turkey, India, and Iran, which have become increasingly important trade partners. Companies must have a robust risk management strategy in place and be prepared to adapt to a rapidly changing regulatory and economic environment.

Opportunities in Regional Development

While Moscow and St. Petersburg are the primary commercial hubs, the vast Russian landmass holds immense untapped potential. Secondary cities and regional capitals are experiencing their own construction booms and economic development, creating new, expanding markets for building materials. Companies that can successfully establish distribution networks and marketing strategies in these regions will find significant growth opportunities away from the crowded major metropolitan areas.

The Rise of E-commerce and Digital Marketing

The Russian consumer is highly digital, and e-commerce has grown exponentially, especially for home goods and building materials. Online platforms and marketplaces are becoming crucial channels for both B2C and B2B sales. Companies that invest in a strong online presence, including user-friendly websites, compelling social media content, and targeted digital advertising, will have a significant competitive advantage. This digital shift also allows smaller or international brands to reach consumers directly without needing a large physical retail footprint.

Strategic Recommendations for Entering or Expanding in the Market

For businesses looking to succeed in the Russian tile and ceramic market, a strategic approach is essential.

Localizing Products and Marketing

A “one-size-fits-all” approach will not work. Success depends on localizing products to meet specific Russian needs and preferences, such as offering a wider range of frost-resistant tiles or patterns that appeal to local aesthetics. Marketing campaigns should also be culturally sensitive and leverage local influencers and platforms to build brand trust.

Building Strong Distribution Channels

Given Russia’s size, having a robust and reliable distribution network is paramount. This may involve partnering with local distributors who have established relationships with retail chains, construction companies, and designers. Building strong, long-term partnerships is key to navigating the complexities of the Russian logistics landscape.

Focusing on Quality and the Price-Value Proposition

Russian consumers are not just looking for the cheapest option; they are looking for value. Brands that can demonstrate superior quality, durability, and a compelling design aesthetic at a competitive price point will thrive. Highlighting technical specifications and certifications can be an effective way to communicate quality and build consumer confidence.

Conclusion

The Russian tile and ceramic market is a complex yet highly promising arena for international businesses. Its landscape is shaped by a powerful combination of economic forces, from urban development to geopolitical shifts, and a rich tapestry of cultural influences that define consumer tastes. While challenges like economic volatility and sanctions require careful navigation, the market’s immense size, the ongoing demand for housing, and the growing openness to modern design trends present significant opportunities.

To succeed in this unique environment, businesses must move beyond a superficial understanding. They need to develop strategies that are deeply informed by local economic realities, sensitive to cultural nuances, and agile enough to adapt to a rapidly changing world. By focusing on localized products, building strong partnerships, and communicating a clear value proposition, companies can successfully unlock the vast potential of the Russian market and secure a strong foothold in this dynamic industry.

نظرات ۰