The tile and ceramic industry is a cornerstone of industrial production in both Iran and Pakistan, rooted in rich historical traditions and bolstered by modern manufacturing capabilities. In Iran, the industry thrives on abundant raw materials and a legacy of craftsmanship, while in Pakistan, it is driven by growing domestic demand and strategic trade relationships. This strategic analysis explores the internal and external factors shaping the tile and ceramic sectors in these two nations, offering insights into their competitive positions, challenges, and future potential. By employing a SWOT framework and examining market trends, production capacities, and export dynamics, this article aims to illuminate the strategic pathways forward for Iran and Pakistan in this vital industry.

Overview of the Tile and Ceramic Industry

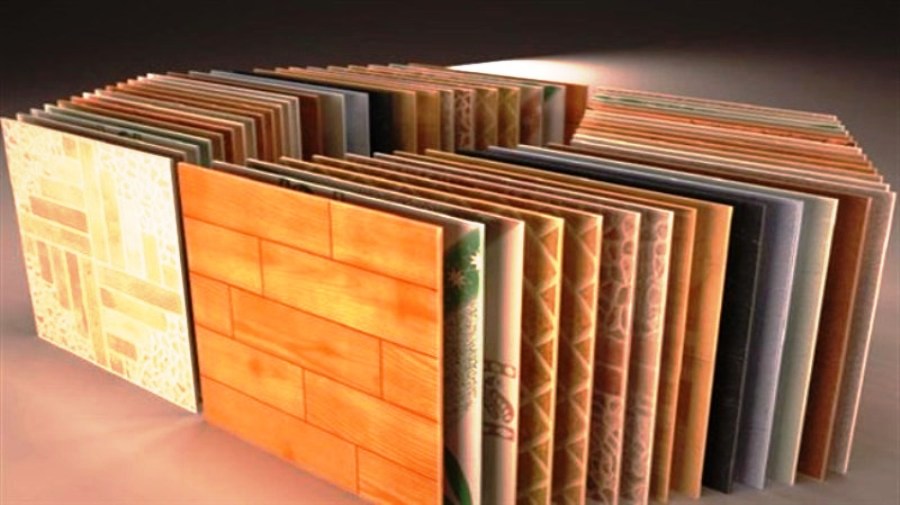

The tile and ceramic industry encompasses the production of ceramic tiles, porcelain tiles, sanitary ware, and decorative ceramics, serving both functional and aesthetic purposes in construction and interior design. Globally, the industry is dominated by countries like China, Italy, and Spain, but regional players like Iran and Pakistan have carved out significant niches, particularly in the Middle East and South Asia. Iran ranks among the top five global producers, with an annual capacity exceeding 700 million square meters, while Pakistan’s industry, though smaller, is expanding rapidly, with a market value reaching $40 million in 2024.

Both countries benefit from strategic geographic locations, cultural affinity for decorative arts, and access to raw materials like clay, kaolin, and feldspar. However, their trajectories differ due to economic policies, infrastructure, and export strategies, making a comparative strategic analysis essential for understanding their competitive dynamics.

SWOT Analysis: Iran

Strengths

Abundant Raw Materials: Iran possesses vast reserves of clay, kaolin, and other minerals, with over 30% of raw materials sourced domestically, reducing import dependency.

Historical Expertise: A legacy of pottery and tile-making dating back to 1250 BC provides Iran with a skilled workforce and artistic heritage, evident in the intricate designs of its products.

Production Capacity: With approximately 147 factories, Iran’s annual output ranges between 300-400 million square meters, supported by modern technology in key hubs like Yazd.

Export Markets: Iran exports to over 50 countries, with strong demand in neighboring markets like Iraq (73% of exports), Pakistan, and Central Asia, bolstered by trade agreements such as the Eurasian Economic Union (EEU) pact.

Weaknesses

Overproduction and Domestic Slump: A construction sector recession has led to excess inventory, price wars, and quality compromises, weakening domestic market stability.

Sanctions and Export Barriers: International sanctions limit access to advanced machinery and global markets beyond neighboring countries, increasing production costs.

Incomplete Supply Chain: Despite rich kaolin reserves, insufficient investment in processing forces reliance on imported materials, raising costs and delays.

Lack of Marketing Infrastructure: Weak branding and distribution channels hinder Iran’s ability to compete with global leaders like Italy and China.

Opportunities

Technological Advancements: Investing in digital printing and energy-efficient kilns could enhance product quality and competitiveness.

Market Diversification: Expanding beyond traditional markets (e.g., Russia, Turkey) could reduce dependency on volatile neighbors like Iraq.

Government Support: Initiatives like the National Housing Project promise to revive domestic demand, while preferential trade deals could boost exports.

Threats

Global Competition: Low-cost producers like China and innovative leaders like Spain threaten Iran’s market share.

Economic Instability: Currency fluctuations and sanctions-induced inflation increase production costs, eroding price competitiveness.

Quality Decline: Price reductions to clear inventory risk damaging Iran’s reputation for high-quality tiles.

SWOT Analysis: Pakistan

Strengths

Growing Domestic Market: Pakistan’s population of over 230 million and rapid urbanization drive demand for tiles in residential and commercial construction.

Strategic Trade Ties: Proximity to Iran and trade agreements facilitate cost-effective imports of Iranian tiles, supplementing local production.

Cost Advantage: Lower labor and transportation costs, especially for imports from Iran via land routes, enhance affordability.

Export Potential: Emerging exports to markets like Mozambique, Qatar, and the UAE signal Pakistan’s growing role in regional trade.

Weaknesses

Limited Production Capacity: Pakistan’s industry is smaller and less developed than Iran’s, with reliance on imports to meet demand.

Quality Variability: Inconsistent standards among local producers hinder competitiveness against imported high-quality tiles.

Infrastructure Gaps: Underdeveloped manufacturing and logistics infrastructure limit scalability and export growth.

Import Dependency: Heavy reliance on imports from China, Iran, and the UAE exposes Pakistan to price volatility and supply chain risks.

Opportunities

Industrial Expansion: Investments in local manufacturing could reduce import reliance and position Pakistan as a regional producer.

Cultural Preferences: Demand for stone and rustic designs, popular in both Iran and Pakistan, offers a niche for localized production or imports.

Trade Exhibitions: Participation in international fairs could boost visibility and attract foreign investment or partnerships.

Threats

Competition from Imports: Low-cost Chinese tiles and high-quality European products challenge local producers and Iranian imports alike.

Economic Pressures: Inflation and currency depreciation increase import costs, squeezing profit margins for traders and manufacturers.

Regulatory Hurdles: Fluctuating tariffs (5-25%) and bureaucratic delays in customs clearance complicate trade dynamics.

Comparative Market Dynamics

Iran’s tile industry is production-driven, leveraging its large-scale capacity and raw material wealth to serve both domestic and export markets. In contrast, Pakistan’s industry is consumption-driven, with a smaller production base supplemented by imports, particularly from Iran, which accounts for 21% of its tile imports by value. Iran’s export value to Pakistan reached $22.2 million in recent years, reflecting a robust trade relationship fueled by geographic proximity, lower tariffs, and shared design preferences (e.g., green, blue, and rustic patterns).

Iran’s market is semi-consolidated, with major players like RAK Ceramics and Sina Tile dominating, while Pakistan’s is fragmented, with local producers struggling to scale. Iran’s per capita production is 10,000 square meters, aiming to reach Italy’s 25,000, while Pakistan’s production metrics remain modest, underscoring its developmental stage.

Strategic Implications

For Iran

Enhance Export Strategies: Diversifying markets beyond Iraq and Pakistan—targeting Russia or the Gulf—could mitigate risks from regional instability. Strengthening marketing and branding is critical to compete with global leaders.

Invest in Supply Chain: Developing domestic kaolin processing and modernizing equipment would lower costs and improve quality, addressing sanctions-related constraints.

Leverage Government Initiatives: Aligning with housing projects and trade pacts like the EEU could stabilize domestic demand and boost exports.

For Pakistan

Boost Local Production: Investing in factories and technology transfers from Iran could reduce import dependency and create jobs, capitalizing on growing demand.

Strengthen Trade Ties: Deepening partnerships with Iran through joint ventures or exhibitions could secure a steady supply of quality tiles at competitive prices.

Focus on Niche Markets: Catering to local tastes with affordable, durable designs could differentiate Pakistan from import-heavy competitors.

Future Outlook

The tile and ceramic industry in Iran and Pakistan stands at a crossroads. Iran’s challenge lies in balancing its production prowess with market access and quality control, potentially reclaiming its status among the world’s top producers. Pakistan, meanwhile, has the opportunity to transition from a consumer to a producer, leveraging its strategic position and Iran’s expertise. Sustainability will be key for both—adopting eco-friendly production and meeting global standards could open new markets. As construction booms in South Asia and the Middle East, the synergy between Iran’s supply and Pakistan’s demand could redefine their roles in the global industry.

Conclusion

The strategic analysis reveals that Iran and Pakistan’s tile and ceramic industries are complementary yet distinct. Iran’s strengths in production and heritage position it as a regional leader, but it must overcome export and quality hurdles. Pakistan’s growing market and trade advantages offer potential, contingent on industrial development. Together, they can harness shared opportunities—technological innovation, cultural resonance, and regional trade—to shape a competitive future in interior design and construction. The path forward demands strategic vision, investment, and collaboration, ensuring that both nations capitalize on their unique strengths in this timeless industry.

نظرات ۰