In an era where global trade dynamics are rapidly shifting due to geopolitical tensions, economic sanctions, and emerging alliances, the relationship between Iran and Russia stands out as a beacon of resilience and growth. As we navigate through 2025, the bilateral trade between these two nations has witnessed an explosive surge, with projections indicating a potential doubling in key sectors like agriculture and manufacturing. This isn’t just about numbers—it’s about real, tangible opportunities for businesses to expand their horizons. For Iranian exporters, particularly those in the ceramic tile industry, this evolving partnership opens doors to a vast Russian market hungry for high-quality, affordable building materials. Imagine tapping into a market where demand for durable, aesthetically pleasing tiles is booming amid Russia’s ongoing infrastructure projects and residential developments. This article delves deep into the remarkable growth of Iran-Russia trade relations in 2025, explores the untapped potential for ceramic tile exports, and provides practical strategies to capitalize on these opportunities. Whether you’re a manufacturer, exporter, or investor, the insights here will equip you with the knowledge to navigate this promising landscape successfully.

Overview of Iran-Russia Trade Relations in 2025

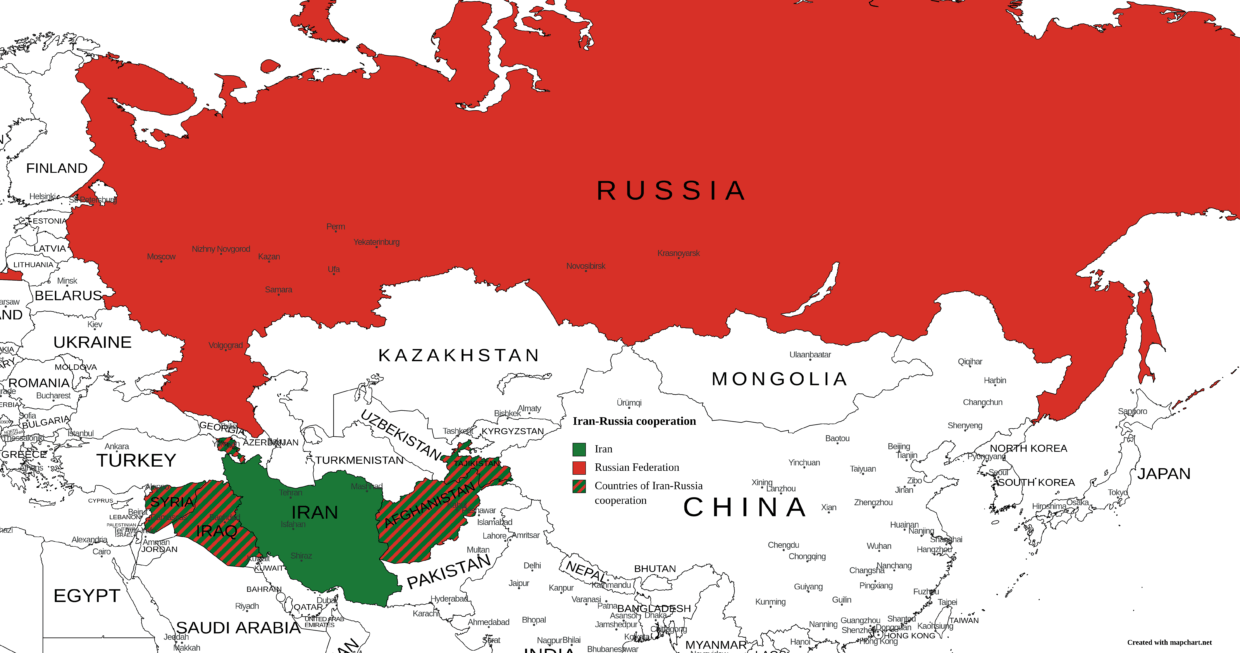

The trade ties between Iran and Russia have evolved from modest exchanges to a robust strategic partnership, driven by mutual interests in bypassing Western sanctions and fostering economic independence. In 2025, this relationship has reached new heights, with trade volumes reflecting a steady upward trajectory that benefits both economies.

Historical Context of Bilateral Trade

To understand the current boom, it’s essential to look back at the foundations. Iran and Russia have shared diplomatic relations for centuries, but modern trade intensified in the early 2000s with energy collaborations and arms deals. By the 2010s, as international sanctions tightened on both nations—Russia due to its actions in Ukraine and Iran over its nuclear program—they turned to each other for support. Trade agreements like the Eurasian Economic Union (EAEU) preferential trade deal, which Iran joined in 2019, laid the groundwork for tariff reductions and easier market access.

Fast-forward to the pre-2025 period: In 2024, bilateral trade grew by 13%, reaching approximately $5 billion, according to official reports. This growth was fueled by Iran’s exports of agricultural products, petrochemicals, and construction materials, while Russia supplied machinery, grains, and technology. The COVID-19 pandemic and subsequent global supply chain disruptions further highlighted the need for reliable partners, prompting both countries to deepen ties through initiatives like the International North-South Transport Corridor (INSTC), which reduces shipping times and costs between the two nations.

In practical terms, this historical buildup means that businesses today can leverage established frameworks. For instance, Iranian exporters benefit from reduced customs duties on non-oil goods, making products like ceramic tiles more competitive. Understanding this context helps exporters appreciate why 2025 is a pivotal year—it’s not a sudden spike but a culmination of years of strategic alignment.

Recent Developments and Growth Projections

Entering 2025, the trade turnover between Iran and Russia has already shown impressive gains. In the first half of the year, mutual trade increased by over 11.4%, building on the previous year’s momentum. Key drivers include Russia’s pivot away from European suppliers due to ongoing sanctions and Iran’s push to diversify its export markets beyond traditional partners like China and Iraq.

Projections for the full year are optimistic: Analysts forecast a trade volume exceeding $6 billion, with potential to reach $10 billion by 2026 if current trends hold. Agricultural trade alone is expected to double to $3 billion in 2026, but manufacturing sectors, including building materials, are also poised for expansion. Russia’s investments in Iran have surged, making it the top foreign investor in 2024 with commitments up to $8 billion, primarily in gas infrastructure but spilling over into related industries like construction.

These developments create a fertile ground for specific sectors. For ceramic tile exporters, the INSTC’s efficiency—cutting transit times from 45 days via sea to just 25 days by rail—means faster delivery and lower costs. Moreover, joint ventures in logistics and banking, such as the use of national currencies for transactions to avoid SWIFT-related issues, streamline payments and reduce risks. Businesses can practically apply this by partnering with Russian logistics firms familiar with the corridor, ensuring seamless exports.

The Ceramic Tile Industry in Iran

Iran’s ceramic tile sector is a powerhouse, ranking among the world’s top producers and exporters. With a rich history in craftsmanship combined with modern technology, Iranian tiles are renowned for their quality, variety, and affordability, making them ideal for international markets like Russia.

Production Capabilities and Capacity

Iran boasts an annual production capacity of over 500 million square meters of ceramic tiles, supported by more than 150 factories equipped with state-of-the-art machinery from Italy and Spain. Key production hubs in Yazd, Isfahan, and Tehran utilize abundant local raw materials like clay, feldspar, and silica, keeping costs low while maintaining high output.

In 2025, the industry has seen a 10-15% increase in production due to government incentives for exports, including subsidies on energy and raw materials. This scalability allows manufacturers to meet large orders without delays. For exporters eyeing Russia, this means reliable supply chains—factories can produce customized tiles in various sizes (from 30×60 cm to 120×240 cm), finishes (glazed, matte, or polished), and designs (traditional Persian motifs or modern minimalist styles).

Practically, businesses should conduct factory audits to ensure compliance with international standards like ISO 9001, which many Iranian producers hold. Investing in digital printing technology, prevalent in top factories, enables quick prototyping for Russian clients, enhancing responsiveness to market demands.

Quality Standards and Innovations

Quality is a cornerstone of Iran’s ceramic tile industry. Tiles undergo rigorous testing for durability, water absorption (typically under 0.5% for porcelain varieties), and frost resistance, making them suitable for Russia’s harsh winters. Innovations in 2025 include eco-friendly production methods, such as using recycled materials and low-emission kilns, aligning with global sustainability trends.

Iranian tiles often exceed European standards, with certifications from bodies like the Iranian National Standards Organization (INSO) and international labs. For example, anti-bacterial coatings and slip-resistant surfaces are now standard in many lines, appealing to Russian construction projects in hospitals and public spaces.

Exporters can leverage these features by highlighting them in marketing materials. A practical tip: Obtain third-party certifications like CE marking for easier entry into EAEU markets, which Russia leads. This not only builds trust but also differentiates Iranian products from competitors like China, which may offer lower prices but inferior quality in some cases.

Market Opportunities in Russia for Iranian Ceramic Tiles

Russia’s tile market is expansive, valued at over $2 billion in 2025, with growing demand driven by urbanization and infrastructure investments. Iranian exporters are uniquely positioned to capture a larger share, especially as European suppliers face barriers.

Demand Trends in the Russian Market

Russia imports around 100 million square meters of tiles annually, with a shift toward premium yet affordable options. In 2025, the market has grown by 8-10% due to government-backed housing programs and commercial developments in cities like Moscow and St. Petersburg. Porcelain tiles, known for their strength, dominate demand, particularly in outdoor and high-traffic areas.

Key trends include a preference for large-format tiles and sustainable products. With Russia’s climate, frost-resistant tiles are essential, and Iranian varieties excel here. Opportunities abound in segments like residential renovations (post-sanctions, many Russians are upgrading homes) and mega-projects such as the Moscow Metro expansions.

Practically, exporters should analyze market data from sources like Rosstat to identify high-demand regions. For instance, Siberia’s oil-rich areas need durable tiles for industrial facilities, while the Black Sea coast favors decorative options for tourism infrastructure.

Competitive Advantages of Iranian Tiles

Iranian ceramic tiles hold several edges over rivals. Price-wise, they are 20-30% cheaper than European brands due to lower production costs and proximity via the INSTC. Quality matches or surpasses that of Turkey and India, with unique designs drawing from Persian artistry.

In 2025, sanctions have created voids: European tiles from Italy and Spain are scarce, pushing Russian buyers toward alternatives. Iran’s non-alignment with Western sanctions allows seamless trade. Additionally, cultural affinities—shared history and growing tourism—foster brand loyalty.

To capitalize, exporters can offer bulk discounts or bundled services like installation training. Building relationships through trade fairs, such as MosBuild in Moscow, provides direct access to buyers, turning opportunities into contracts.

Strategies for Successful Export to Russia

Exporting ceramic tiles to Russia requires careful planning, but with the right approach, it can be highly profitable. Focus on compliance, logistics, and marketing to ensure smooth operations.

Navigating Sanctions and Regulations

Sanctions pose challenges, but they’re navigable. Russia and Iran use alternative payment systems like MIR and Shetab cards, or barter arrangements. For 2025, ensure compliance with EAEU customs rules: Tiles need certificates of origin and conformity assessments.

Practical steps: Engage legal experts in Tehran or Moscow for due diligence. Use free trade zones like Iran’s Anzali or Russia’s Vladivostok for testing shipments. Avoid dual-use items to prevent scrutiny, and document everything meticulously to facilitate inspections.

Logistics and Supply Chain Management

Efficient logistics are key. The INSTC offers rail and road options, reducing costs by 30% compared to sea routes. In 2025, enhanced port facilities in Bandar Abbas and Astrakhan speed up transit.

Tips: Partner with experienced forwarders like Iran’s IRISL or Russian firms. Use containerized shipping for tiles to prevent damage, and invest in insurance covering geopolitical risks. Track shipments via GPS for real-time updates, ensuring timely delivery to Russian distributors.

Marketing and Building Partnerships

Marketing should emphasize quality and value. Digital campaigns on platforms like VK (Russia’s social media) can target architects and builders. Attend expos and form joint ventures with Russian companies for local distribution.

Practically, create Russian-language catalogs and websites optimized for Yandex search. Offer samples and pilot projects to build trust. Long-term, establish warehouses in Russia to reduce lead times, turning one-time sales into ongoing partnerships.

Case Studies and Success Stories

Real-world examples illustrate the potential. One Iranian firm, based in Yazd, exported 500,000 square meters of porcelain tiles to Russia in early 2025, securing a contract for Moscow’s residential complexes. By customizing designs and navigating logistics via INSTC, they achieved 25% profit margins.

Another success: A Tehran exporter partnered with a Russian retailer, using barter (tiles for machinery) to bypass currency issues. This led to a 40% sales increase. These stories show that with adaptability, exporters can overcome hurdles and thrive.

Future Projections and Recommendations

Looking ahead, Iran-Russia trade could hit $10 billion by 2027, with ceramic tiles contributing significantly. Recommendations: Invest in R&D for innovative products, diversify markets within Russia, and monitor geopolitical shifts.

Stay updated via chambers of commerce and use data analytics for forecasting demand. Sustainability will be key—adopt green practices to appeal to eco-conscious buyers.

Conclusion

The surging Iran-Russia trade relations in 2025 represent a golden era for economic collaboration, particularly in the ceramic tile sector. From historical foundations to current growth and future projections, the opportunities are vast and practical. By understanding market demands, leveraging competitive advantages, and implementing strategic exports, Iranian businesses can secure a foothold in Russia’s dynamic market. This isn’t just about exports; it’s about building lasting partnerships that drive mutual prosperity. As global trade evolves, seizing these moments could redefine your business trajectory—start planning today for a brighter tomorrow.

نظرات ۰