In recent years, the Russian construction and interior design sectors have undergone a major transformation. From Moscow’s high-end residential developments to luxury hotels in St. Petersburg and Sochi, a growing appetite for premium materials has reshaped the country’s tile market. Among the most notable trends is the surging demand for luxury tiles, a segment that reflects not only aesthetic preferences but also shifts in consumer behavior, architectural innovation, and international trade relations.

This article offers a comprehensive analysis of the demand trends for luxury tiles in the Russian market, exploring key growth factors, market drivers, import patterns, and future forecasts. It also provides valuable insights for manufacturers, exporters, and distributors—particularly those from countries like Iran, India, Italy, and Spain, which play a significant role in Russia’s premium tile supply chain.

۱. Overview of the Russian Tile Market

The Russian tile industry is one of the most dynamic in Eastern Europe. Historically, it has relied on imports from Southern and Western Europe, but recent economic shifts and international sanctions have diversified its supply sources. Domestic manufacturers have improved their technology and design standards, while foreign suppliers—especially from Asia and the Middle East—have captured growing market share.

Luxury tiles, defined by their design sophistication, material quality, and innovative finishes, account for a smaller volume but a larger value segment of the market. Over the last five years, demand for luxury tiles in Russia has grown by approximately ۱۵–۲۰% annually, driven by both residential and commercial projects that prioritize high aesthetics and durability.

۲. Factors Driving the Demand for Luxury Tiles

۲.۱. Urban Development and Premium Real Estate Growth

Rapid urbanization and the expansion of premium housing developments have been key drivers of tile consumption. In major cities such as Moscow, St. Petersburg, and Yekaterinburg, high-income consumers and developers are increasingly turning to imported luxury tiles to differentiate their projects. Luxury apartments, villas, and penthouses often feature porcelain slabs, marble-look ceramics, and designer mosaic tiles as status symbols of sophistication and wealth.

۲.۲. Changing Consumer Preferences

Russian consumers have become more design-conscious over the past decade. With greater exposure to global interior design trends through digital media, there is a growing appreciation for minimalist, natural, and sustainable aesthetics. The modern Russian buyer values texture, surface innovation, and authenticity, driving demand for matte, polished, and 3D surface finishes in luxury tile collections.

۲.۳. Hotel and Commercial Construction Boom

The Russian hospitality industry, particularly in cities preparing for tourism expansion and international events, has boosted the need for high-end wall and floor coverings. Luxury tiles are now a default choice for five-star hotels, upscale restaurants, wellness centers, and shopping complexes, where durability and visual appeal are equally critical.

۲.۴. Shifts in Supply Chain and Import Sources

Due to trade restrictions with the EU, Russian importers have increasingly turned to suppliers from Asia and the Middle East, especially Iran, India, China, and Turkey. These regions have responded by developing premium tile collections tailored to Russian design preferences—such as marble, stone, and wood-effect porcelain tiles that combine affordability with high aesthetic standards.

۳. Key Market Segments in Luxury Tiles

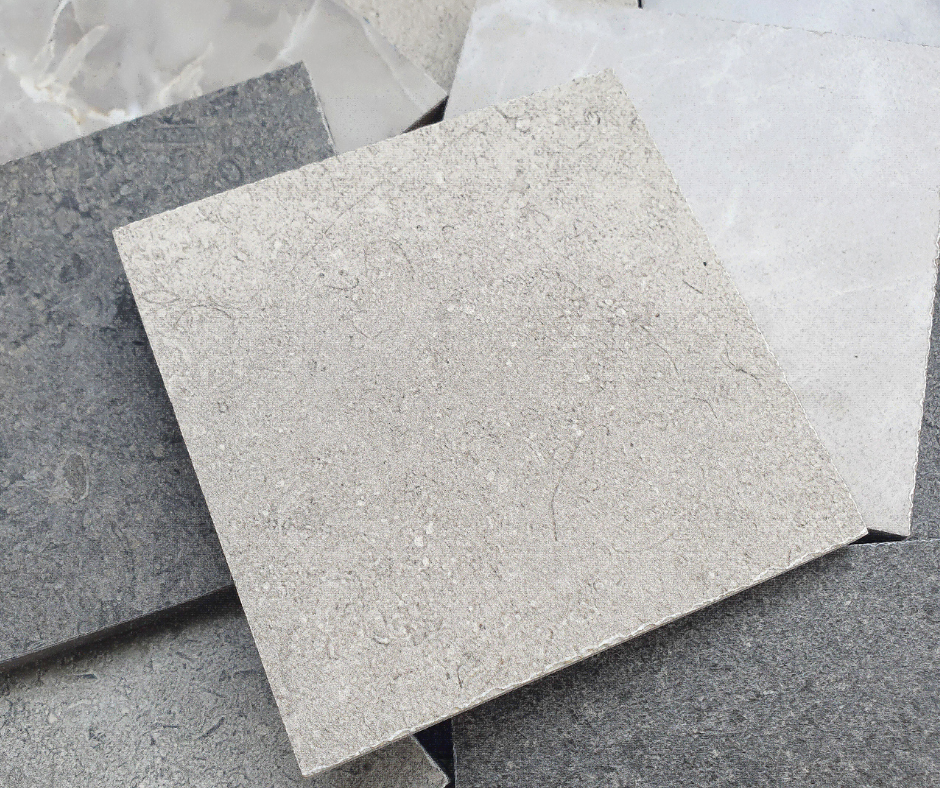

۳.۱. Porcelain Tiles

Porcelain tiles dominate the luxury category due to their durability, low water absorption, and high-end finishes. Popular designs include Italian-style marble look, onyx patterns, and large-format slabs that mimic natural stone while offering superior performance.

۳.۲. Ceramic Tiles with Artistic Designs

Handcrafted and digitally printed ceramic tiles are gaining attention in Russia’s interior design community. Artisanal motifs, geometric patterns, and glossy finishes are particularly sought after for bathrooms, kitchens, and decorative walls.

۳.۳. Mosaic and Glass Tiles

The luxury mosaic segment, although niche, is expanding rapidly among architects and designers. Glass mosaics and metallic tiles are widely used in spas, swimming pools, and high-end lobbies, where elegance and color depth are paramount.

۳.۴. Large Format Slabs

A recent favorite in the Russian market, large-format slabs (120×240 cm or larger) offer seamless installations and a luxurious appearance. These slabs are preferred in modern architecture and commercial spaces, particularly where visual continuity and sophistication are key.

۴. Design and Surface Finish Trends

۴.۱. Marble and Stone Effects

Marble-look porcelain remains the top trend in the luxury tile segment. Russian architects appreciate white Carrara, Calacatta Gold, and Nero Marquina designs for their timeless elegance. The combination of classic marble aesthetics with advanced surface technology has made these tiles highly desirable.

۴.۲. Wood and Concrete Textures

As contemporary design leans toward natural and industrial themes, wood-effect and concrete-look tiles are seeing increased adoption. They offer the warmth of natural materials with the low maintenance of ceramics.

۴.۳. Matte and Polished Combinations

The mixing of matte and gloss finishes in a single project is a strong design direction in 2025. Russian designers favor this contrast to create depth and dynamic visual balance, especially in living rooms and luxury bathrooms.

۴.۴. Sustainable and Eco-Friendly Designs

Sustainability is becoming a strong marketing driver. Manufacturers promoting eco-friendly production methods, recycled materials, and low-emission processes are gaining favor among environmentally conscious consumers and developers.

۵. Import and Trade Analysis

۵.۱. Main Suppliers to Russia

- China – Dominates the overall market in volume with competitive prices.

- India – Known for innovation in design and affordable premium quality.

- Iran – A growing supplier of luxury porcelain and marble-look tiles, valued for both design and cost efficiency.

- Turkey – Offers mid-to-high range tiles with European-inspired designs.

Despite logistical challenges, imports from Iran and India have increased significantly since 2022, partly due to established trade partnerships and lower freight costs.

۵.۲. Customs and Distribution Channels

Luxury tiles reach Russian consumers through exclusive distributors, interior design showrooms, and online platforms. Digital marketing has become a powerful tool for promoting imported tiles, allowing international brands to reach both architects and end-users directly.

۶. Pricing and Consumer Behavior

Luxury tile prices in Russia vary widely depending on the origin, size, and finish. Imported porcelain slabs typically range from $۳۰ to $120 per square meter, while custom artistic tiles may exceed $۲۰۰ per square meter. However, Russian buyers are increasingly willing to pay a premium for durability, aesthetics, and brand prestige.

Consumer research indicates that brand storytelling and design inspiration—not just price—play a decisive role in purchasing decisions. This trend has encouraged suppliers to invest in branding, visual merchandising, and showroom experiences.

۷. Marketing and Branding Strategies

To succeed in Russia’s luxury tile market, manufacturers must position their products strategically. Effective approaches include:

- Localized marketing content highlighting Russian design sensibilities.

- Collaborations with architects and influencers in the interior design field.

- Participation in Russian trade fairs, such as MosBuild and Batimat Russia.

- Offering digital visualization tools (e.g., 3D room planners and AR apps) that help clients imagine tiles in real settings.

Strong storytelling around craftsmanship, sustainability, and exclusivity has proven to boost brand loyalty among Russian consumers.

۸. Future Outlook and Opportunities

The luxury tile segment in Russia is expected to continue its steady expansion through ۲۰۳۰, supported by:

- Luxury real estate growth in urban and resort regions.

- Expansion of the hospitality and tourism industries.

- Increased cooperation with Asian and Middle Eastern suppliers.

- Rising consumer appreciation for design and durability.

Moreover, government efforts to promote domestic construction and infrastructure will keep the demand high for imported tiles that meet premium design standards.

Exporters that can combine aesthetics with affordability will be best positioned to capture this lucrative segment. Iran, in particular, has a strategic advantage due to geographical proximity, cultural alignment in design preferences, and growing logistics efficiency.

Conclusion

The demand for luxury tiles in Russia reflects much more than a design trend—it’s a clear indicator of evolving lifestyles, construction standards, and global trade realignments. As Russian consumers continue to embrace sophistication, sustainability, and individuality in their spaces, luxury tile imports will remain a vital component of the market’s future.

For international manufacturers and exporters, the message is clear:

Focus on innovation, branding, and cultural adaptation to thrive in this rapidly evolving and high-value market.

نظرات ۰