Survey of ceramic tiles in the Russian construction industry

The volume of consumption of facing ceramic tiles per capita in Russia reached a record of 690.25 rubles/person

The volume of consumption of facing ceramic tiles per capita in Russia in 2022 reached a record value of 690.25 rubles/person, which is 28.7% more than a year earlier. Such data in August 2023 were published by analysts of the market research agency GuideMarket.

According to experts, the Russian ceramic tile market continues to develop, despite some fluctuations in consumption volumes. According to the study, the average annual increase in consumption is 9.7%.

According to the researchers, one of the noticeable trends in consumer preferences in the market is the growth in demand for natural and environmentally friendly materials. Consumers are increasingly paying attention to the environmental safety and sustainability of materials, and ceramic tiles, with their natural composition and durability, meet these requirements.

Another trend, analysts called the growing interest in design and diversity. Consumers are looking for unique and stylish solutions for their interiors, and ceramic tile manufacturers are responding to this demand by offering a wide range of colors, textures and formats.

The next trend is the growing demand for decorative elements and ceramic tile mosaics. In addition, there has been an increase in interest in innovative technologies and new materials in the production of ceramic tiles. Manufacturers are introducing new processing and coating methods, creating tiles with improved characteristics, such as resistance to scratches, stains and moisture. Finally, analysts note the growing popularity of large tile formats. Large tiles create a space effect and minimize the number of stitches, making the interiors more modern and stylish.[15]

Imports of ceramic tiles decreased by 53.7%, exports – by 79.9%

The volume of exports of ceramic tiles and porcelain stoneware from Russia amounted to 5.5 thousand square meters. m, which is 79.9% less than a year earlier. Imports of these products also decreased significantly – by 53.7%, to 25 thousand square meters. m. This is evidenced by data from a study conducted by NeoAnalytics. Some excerpts from this report were published in July 2023.

According to the study, sales of ceramic tiles and porcelain tiles in Russia in 2022 exceeded 200 thousand square meters. m, which is 3.7% less than a year ago. The peak of sales in retrospect of the period 2018-2022 occurred in 2021, when deferred consumer solvent demand was implemented after the pandemic (we are talking about the COVID-19 coronavirus pandemic) 2020. In addition, in 2021, a positive trend in the volume of housing construction continued.

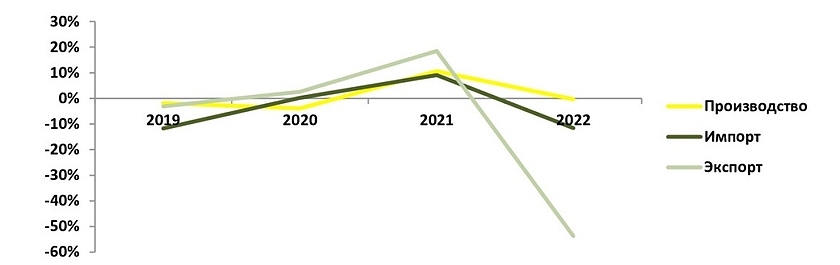

In 2022, negative dynamics was observed in all three segments: production, import and export. However, if domestic output decreased slightly, then export-import supplies fell significantly, both in kind and in value. The share of domestic production prevails in the structure of the ceramic tile and porcelain stoneware market volume, which in 2022 was about 90%.

Domestic production of ceramic tiles and porcelain tiles in physical terms in 2022 decreased by 0.3% compared to the same indicator a year earlier. In the structure of importing countries, the leader has changed – Italy, which in 2021 ranked first, a year later dropped to second. Who in 2022 is located on the first line, NeoAnalytics does not specify.

The average retail cost of ceramic tiles in Russia in 2022 increased by 1.9% compared to 2021 – to 789.2 rubles.[16]

Sales of self-cutting screws in Russia decreased after an increase of 40.1% – to 111.4 thousand tons

In 2022, 111.4 thousand tons of self-cutting vehicles were sold in Russia, which is 24.8% less than a year earlier, when the market volume showed 40.1% growth. This is evidenced by the data of analysts at GuideMarket. Excerpts from their study were published on July 12, 2023.

According to experts, the volume of the Russian self-cutting market has multidirectional dynamics in physical terms. This is due to fluctuations in import volumes and high demand for self-cutting screws.

In 2021, the market volume reached a maximum value of 148.08 thousand tons, while the share of imported products amounted to 95.9%. In 2020, the market volume fell to 105.69 thousand tons due to a reduction in imports and domestic production due to the COVID-19 pandemic and the closure of borders.

According to the study, in 2022 the volume of self-cutting in Russia amounted to 10,387 tons, which is 4.4% more than a year ago. Experts emphasize that the dynamics of production volumes does not always correlate with the dynamics of the volume of the domestic self-cutting market. To a greater extent, the volume of the market depends on the volume of imports and its fluctuations. A more detailed examination of the import and export indicators shows that the share of exports in the production of self-cutting screws is significant.

State support measures and import substitution programs contribute to the development of domestic production. In April 2022, NLMK-Sort (part of the NLMK group) announced that the issue of localizing the production of self-cutting screws in Russia is more acute than the production of nails, since 85% of self-cutting screws on the Russian market are imported. The company pointed out that with a low volume of investments in production and the availability of sufficient raw materials, entrepreneurs do not go to this segment of the market due to cheaper and less high-quality imports.[17]

Production of heat and insulation materials in Russia decreased by 8.3% (to 78 million cubic meters) after an increase of 30.9%

The production of heat and insulation materials and products in Russia in 2022 turned out to be equal to 78 million cubic meters, which is 8.3% less than in the previous year, when there was an increase of 30.9%. Such data in June 2023 leads BusinesStat analysts.

According to them, the sanctions crisis, on the one hand, led to a decline in sales within the country, on the other, to a loss of buyers from abroad, and, consequently, a decrease in exports of products.

According to the study, heat and insulation materials of domestic production prevail on the Russian market, and the production structure as a whole repeats the sales structure. In 2018-2022 the share of mineral insulation averaged 57% of all-Russian production, the share of polymer insulation – 23%, the share of fiberglass-based products – 20%.

From the report published in June 2023, it also follows that in Russia the last 7 years have not opened new enterprises for the production of mineral fiber, which experts attribute to the high cost of equipment and the long payback period of new plants, as well as the lack of finished infrastructure. Market participants note that the capacity for the production of mineral insulation was almost completely loaded at the end of 2020, and in 2021 there were difficulties with meeting the new round of demand. As a result, some consumers reoriented to other types of isolation.

In 2018-2022 imports of heat and insulation materials and products to Russia decreased by 31.8%: from 0.43 to 0.30 million m3. This was mainly influenced by the decline in 2022 (-34.2%). The sanctions affected only mineral isolation: the EU and the United States imposed a ban on its supply to Russia. However, many European partners refused to cooperate with Russia: in 2022, imports from the European Union and the United States decreased by 3.7 times: from 0.19 million m3 in 2021 to 0.05 million m3 in 2022.[18]

Russian ceramic tile market sank 49.3% to 2.85 million units

The volume of the Russian ceramic tile market in 2022 amounted to 2.85 million pieces, which is 49.3% less than a year ago. The decline came after an 11.8 percent increase in product sales in 2021, according to analysts at BusinesStat (their study was released in June 2023). According to them, the market sank due to the following factors:

slowdown in construction amid sanctions;

reduced assortment due to limited availability of imported products. The countries EU Great Britain imposed a ban on the export of ceramic tiles to, Russia as a result, the supply of products from manufacturers such as Roben,,, BRAAS Wienerberger Erlus and others was suspended. Due to the lack Russia of shingles in the established serial production, stocks decreased to a critical level, individual brands and colors of shingles were inaccessible, or delivery times increased significantly;

the rise in price of ceramic tiles associated with an increase in transport and logistics costs, interruptions in supplies due to sanctions.

reducing purchasing power and changing consumer behavior of the population. In the context of an increase in the cost of construction, Russians were inclined to save money and made a choice in favor of more budgetary building materials: metal tiles, cement-sand tiles, soft roofs.

In 2022, the export of ceramic tiles fell sharply and amounted to only 0.18 thousand units. The current situation was associated both with a reduction in the export of tiles to Azerbaijan, and with the suspension of supplies to Ukraine against the background of a breakdown in diplomatic and trade relations between the countries. In 2022, sales of ceramic tiles in Russia decreased by 49.3% and amounted to 2.85 million units. The port of ceramic tiles from Russia is extremely small compared to imports, mainly in the nature of unsystematic transactions, so the dynamics of the indicator is unstable, analysts say.[19]

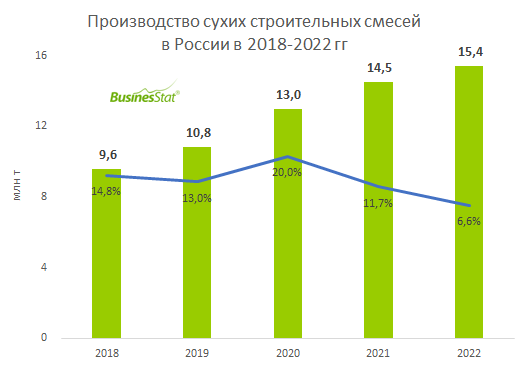

Production of dry building mixtures in Russia jumped by 61.5% to 15.4 million tons

In 2022, the production of dry building mixtures in Russia reached 15.4 million tons, an increase of 61.5% compared to 5 years ago. The high growth rates of the market are explained by the consistently high demand for products within the country, as well as the fact that domestic mixtures successfully compete with foreign counterparts, BusinesStat analysts said in May 2023. According to them, the demand for dry building mixtures grew under the influence of the following factors:

In recent years, there has been a tendency to reorient demand from sand-cement mortars towards dry building mixtures, which are produced at the factory (and not at the construction site), which ensures the stability of the specified properties and the quality of the mortar. Dry building mixtures are often more preferable, since their use increases labor productivity, reduces the cost of materials, and due to mineral and polymer additives, it allows solving specific problems.

Programs of preferential and rural mortgages, maternity capital stimulated mass housing construction.

The lowest growth rate in the production of dry building mixtures was observed in 2022 (+ 6.6%). The main problem for the industry in 2022 was the almost complete disconnection from Western technology. According to experts, 80% of the equipment for the production of dry mixtures is imported.

In 2022, first, the termination of investments in Russia, and then the departure was announced Henkel and, Holcim but their factories continued to work. At the end of the year, Henkel and Holcim transferred the management of Russian assets to local management, now the products will be produced under new brands. However, there was high competition in the market, which could not weaken the departure of foreign manufacturers.[20]

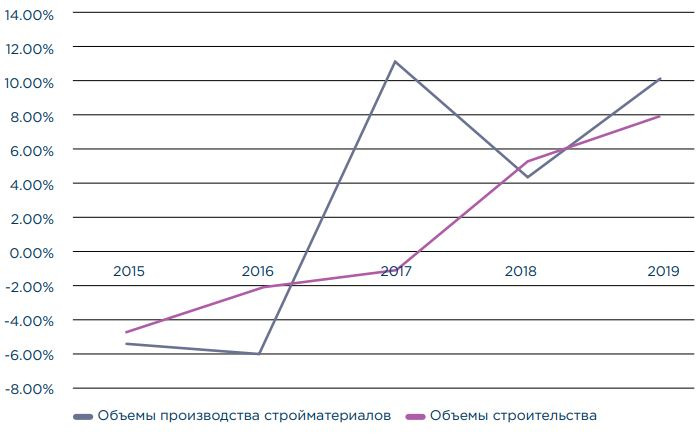

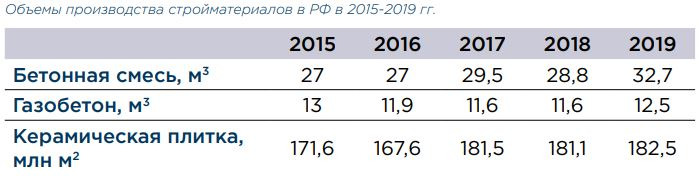

2019: The rise of the market on state programs

In 2019, the renovation program and other state programs contributed to a sharp increase in demand for building materials.

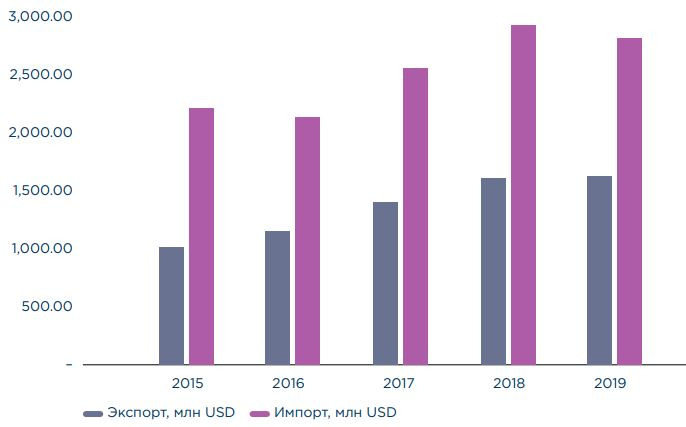

Russia remains one of the largest importers of building materials, but in recent years the authorities have been making efforts to replace imports.

Over the previous few years, the volume of production and sales of gypsum board, sinus slabs, reinforced concrete, dry building mixtures has significantly increased, paints, varnishes and many other types of building materials.

قیمت های موجود در سایت تاریخ بروزرسانی آن ها ذکر شده و قیمت نهایی محصولات نمی باشند. لطفا جهت ثبت سفارش و استعلام قیمت بروز با کارشناسان ما در ارتباط باشید.

(035-3357)